Question: You are working as a Priority Relationship manager in ABC bank. Your client, Ms. Thomas is a surplus unit who has decided to put her

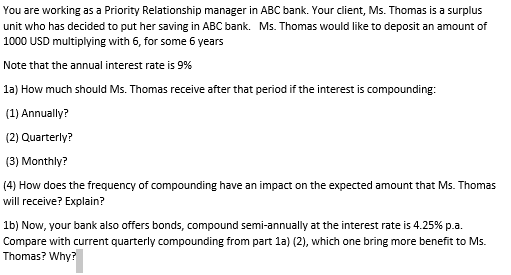

You are working as a Priority Relationship manager in ABC bank. Your client, Ms. Thomas is a surplus unit who has decided to put her saving in ABC bank. Ms. Thomas would like to deposit an amount of 1000 USD multiplying with 6 , for some 6 years Note that the annual interest rate is 9% 1a) How much should Ms. Thomas receive after that period if the interest is compounding: (1) Annually? (2) Quarterly? (3) Monthly? (4) How does the frequency of compounding have an impact on the expected amount that Ms. Thomas will receive? Explain? 1b) Now, your bank also offers bonds, compound semi-annually at the interest rate is 4.25% p.a. Compare with current quarterly compounding from part 1a) (2), which one bring more benefit to Ms. Thomas? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts