Question: You are working for a large data sciences company. The company manages a large number of data centers that require significant amount of cooling to

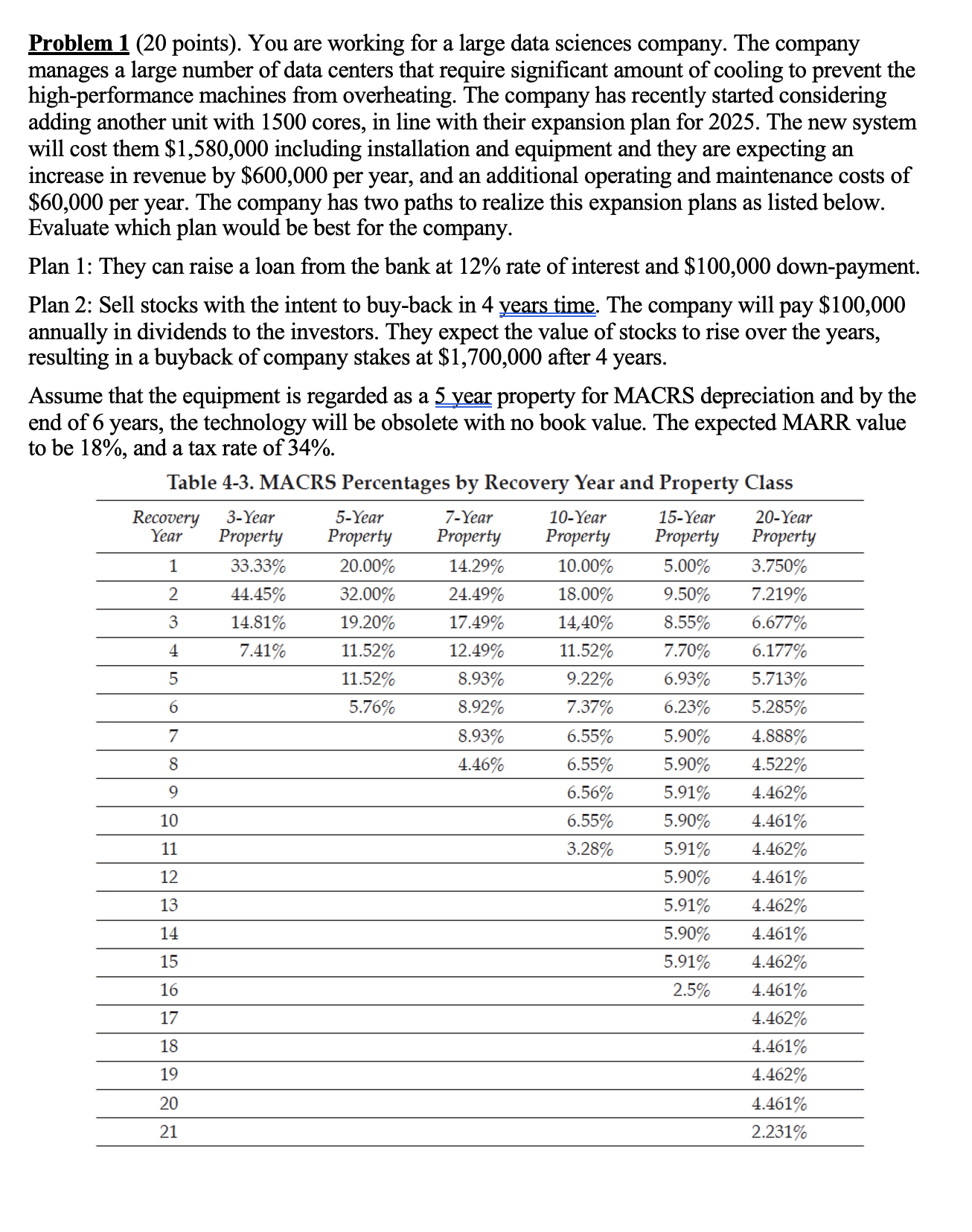

You are working for a large data sciences company. The company manages a large number of data centers that require significant amount of cooling to prevent the highperformance machines from overheating. The company has recently started considering adding another unit with cores, in line with their expansion plan for The new system will cost them $ including installation and equipment and they are expecting an increase in revenue by $ per year, and an additional operating and maintenance costs of $ per year. The company has two paths to realize this expansion plans as listed below. Evaluate which plan would be best for the company. Plan : They can raise a loan from the bank at rate of interest and $ downpayment. Plan : Sell stocks with the intent to buyback in years time. The company will pay $ annually in dividends to the investors. They expect the value of stocks to rise over the years, resulting in a buyback of company stakes at $ after years. Assume that the equipment is regarded as a year property for MACRS depreciation and by the end of years, the technology will be obsolete with no book value. The expected MARR value to be and a tax rate of

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock