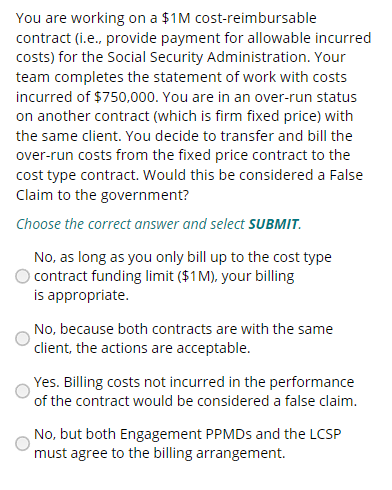

Question: You are working on a $ 1 M cost - reimbursable contract ( i . e . , provide payment for allowable incurred costs )

You are working on a $ costreimbursable

contract ie provide payment for allowable incurred

costs for the Social Security Administration. Your

team completes the statement of work with costs

incurred of $ You are in an overrun status

on another contract which is firm fixed price with

the same client. You decide to transfer and bill the

overrun costs from the fixed price contract to the

cost type contract. Would this be considered a False

Claim to the government?

Choose the correct answer and select SUBMIT.

No as long as you only bill up to the cost type

contract funding limit $ your billing

is appropriate.

No because both contracts are with the same

client, the actions are acceptable.

Yes. Billing costs not incurred in the performance

of the contract would be considered a false claim.

No but both Engagement PPMDs and the LCSP

must agree to the billing arrangement.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock