Question: You are working on a bid for a 4-year contract. Thus far, you have determined that you will need $156,000 for fixed assets that will

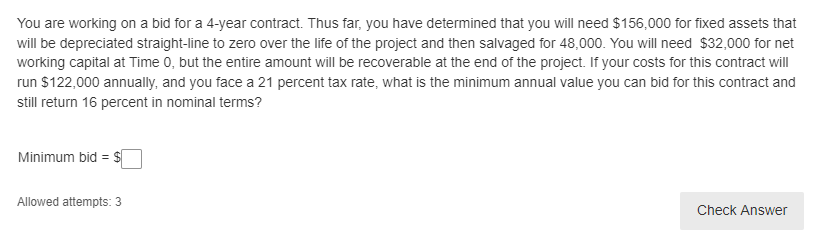

You are working on a bid for a 4-year contract. Thus far, you have determined that you will need $156,000 for fixed assets that will be depreciated straight-line to zero over the life of the project and then salvaged for 48,000 . You will need $32,000 for net working capital at Time 0 , but the entire amount will be recoverable at the end of the project. If your costs for this contract will run $122,000 annually, and you face a 21 percent tax rate, what is the minimum annual value you can bid for this contract and still return 16 percent in nominal terms? Minimum bid =$ Allowed attempts: 3

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock