Question: You are working on a project to replace the CAF temporary shelter systems. After analysing multiple options, you feel the need to analyse two of

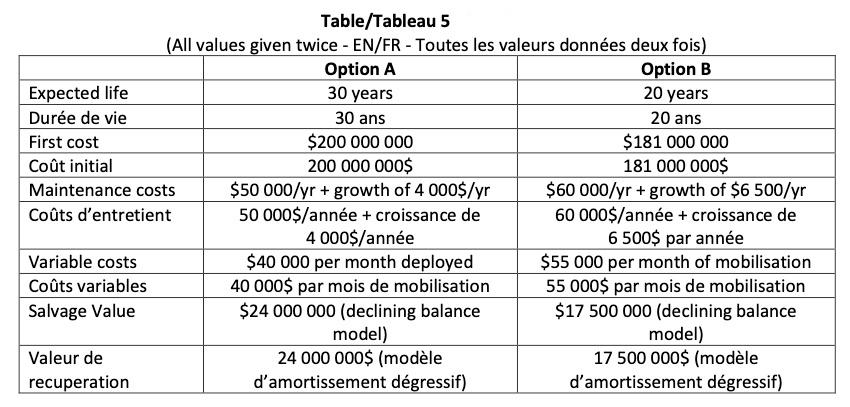

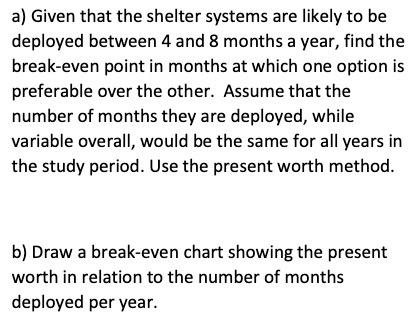

You are working on a project to replace the CAF temporary shelter systems. After analysing multiple options, you feel the need to analyse two of the main bidders more closely. However, you know that the amount of time the assets will be deployed can greatly vary depending on the Canadian political situation and major events. The CAF uses a MARR of 3% per year compounded annually and a study period of 20 years regardless of service life. Use 5 significant digits in all your calculations. Table/Tableau 5 (All values given twice - EN/FR - Toutes les valeurs donnes deux fois) Option A Option B Expected life 30 years 20 years Dure de vie 30 ans 20 ans First cost $200 000 000 $181 000 000 Cot initial 200 000 000$ 181 000 000$ Maintenance costs $50 000/yr + growth of 4 000$/yr $60 000/yr + growth of $6 500/yr Cots d'entretient 50 000$/anne + croissance de 60 000$/anne + croissance de 4000$/anne 6 500$ par anne Variable costs $40 000 per month deployed $55 000 per month of mobilisation Cots variables 40 000$ par mois de mobilisation 55 000$ par mois de mobilisation Salvage Value $24 000 000 (declining balance $17 500 000 (declining balance model) model) Valeur de 24 000 000$ (modle 17 500 000$ (modle recuperation d'amortissement dgressif) d'amortissement dgressif) a) Given that the shelter systems are likely to be deployed between 4 and 8 months a year, find the break-even point in months at which one option is preferable over the other. Assume that the number of months they are deployed, while variable overall, would be the same for all years in the study period. Use the present worth method. b) Draw a break-even chart showing the present worth in relation to the number of months deployed per year. You are working on a project to replace the CAF temporary shelter systems. After analysing multiple options, you feel the need to analyse two of the main bidders more closely. However, you know that the amount of time the assets will be deployed can greatly vary depending on the Canadian political situation and major events. The CAF uses a MARR of 3% per year compounded annually and a study period of 20 years regardless of service life. Use 5 significant digits in all your calculations. Table/Tableau 5 (All values given twice - EN/FR - Toutes les valeurs donnes deux fois) Option A Option B Expected life 30 years 20 years Dure de vie 30 ans 20 ans First cost $200 000 000 $181 000 000 Cot initial 200 000 000$ 181 000 000$ Maintenance costs $50 000/yr + growth of 4 000$/yr $60 000/yr + growth of $6 500/yr Cots d'entretient 50 000$/anne + croissance de 60 000$/anne + croissance de 4000$/anne 6 500$ par anne Variable costs $40 000 per month deployed $55 000 per month of mobilisation Cots variables 40 000$ par mois de mobilisation 55 000$ par mois de mobilisation Salvage Value $24 000 000 (declining balance $17 500 000 (declining balance model) model) Valeur de 24 000 000$ (modle 17 500 000$ (modle recuperation d'amortissement dgressif) d'amortissement dgressif) a) Given that the shelter systems are likely to be deployed between 4 and 8 months a year, find the break-even point in months at which one option is preferable over the other. Assume that the number of months they are deployed, while variable overall, would be the same for all years in the study period. Use the present worth method. b) Draw a break-even chart showing the present worth in relation to the number of months deployed per year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts