Question: You are working on the audit planning section for a new client, Ellis Bait and Tackle Store (EBTS) EBTS is owned by Ellis Dickson who

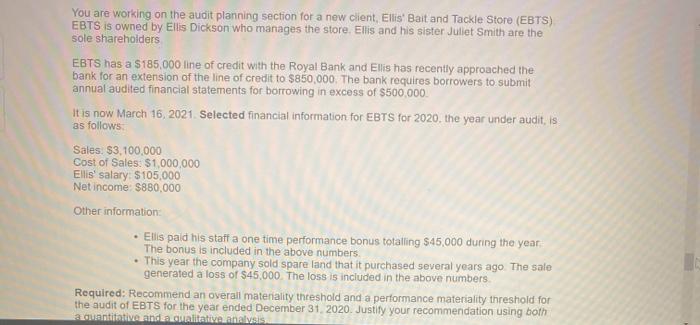

You are working on the audit planning section for a new client, Ellis Bait and Tackle Store (EBTS) EBTS is owned by Ellis Dickson who manages the store. Ellis and his sister Juliet Smith are the sole shareholders EBTS has a $185.000 line of credit with the Royal Bank and Ellis has recently approached the bank for an extension of the line of credit to $850,000. The bank requires borrowers to submit annual audited financial statements for borrowing in excess of $500,000 it is now March 16, 2021. Selected financial information for EBTS for 2020, the year under audit, is as follows Sales: $3,100,000 Cost of Sales: $1,000,000 Ellis' salary: $105,000 Net income $880,000 Other information Ellis paid his staff a one time performance bonus totalling $45,000 during the year The bonus is included in the above numbers This year the company sold spare land that it purchased several years ago The sale generated a loss of $45,000. The loss is included in the above numbers Required: Recommend an overall materiality threshold and a performance materiality threshold for the audit of EBTS for the year ended December 31, 2020. Justity your recommendation using both antivandalitativas You are working on the audit planning section for a new client, Ellis Bait and Tackle Store (EBTS) EBTS is owned by Ellis Dickson who manages the store. Ellis and his sister Juliet Smith are the sole shareholders EBTS has a $185.000 line of credit with the Royal Bank and Ellis has recently approached the bank for an extension of the line of credit to $850,000. The bank requires borrowers to submit annual audited financial statements for borrowing in excess of $500,000 it is now March 16, 2021. Selected financial information for EBTS for 2020, the year under audit, is as follows Sales: $3,100,000 Cost of Sales: $1,000,000 Ellis' salary: $105,000 Net income $880,000 Other information Ellis paid his staff a one time performance bonus totalling $45,000 during the year The bonus is included in the above numbers This year the company sold spare land that it purchased several years ago The sale generated a loss of $45,000. The loss is included in the above numbers Required: Recommend an overall materiality threshold and a performance materiality threshold for the audit of EBTS for the year ended December 31, 2020. Justity your recommendation using both antivandalitativas

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts