Question: You are working on your second project as an equity research intern at a bulge investment bank. Your focus is in retail space, especially in

You are working on your second project as an equity research intern at a bulge investment bank. Your focus is in retail space, especially in the health and fitness sector. Currently, you are gathering information on a fast-growing chain fitness company called LuluYoga. You are interested in calculating the free cash flow of the firm.

LuluYoga offers yoga classes in several major cities in the United States. Two major revenue resources are selling workout gear and membership passes for class access.

Assume at the beginning of year 2016, LuluYoga has zero inventory.

In year 2016, LuluYoga purchased 10,000 yoga mats at a price of $10 each. The company sells 6,000 mats at a price of $15 in year 2016 and sells the remaining at a price of $20 in year 2017.

In year 2016, LuluYoga sells 1,000 membership passes for $2,000 each. 80% of the classes purchased were used in 2016 and the rest are used in 2017.The yoga masters compensation to teach classes are $300K in year 2016 and $200K in year 2017.

LuluYoga pays corporate tax of 35%.

PREVIOUS QUESTIONS THAT I ALREADY ANSWERED:

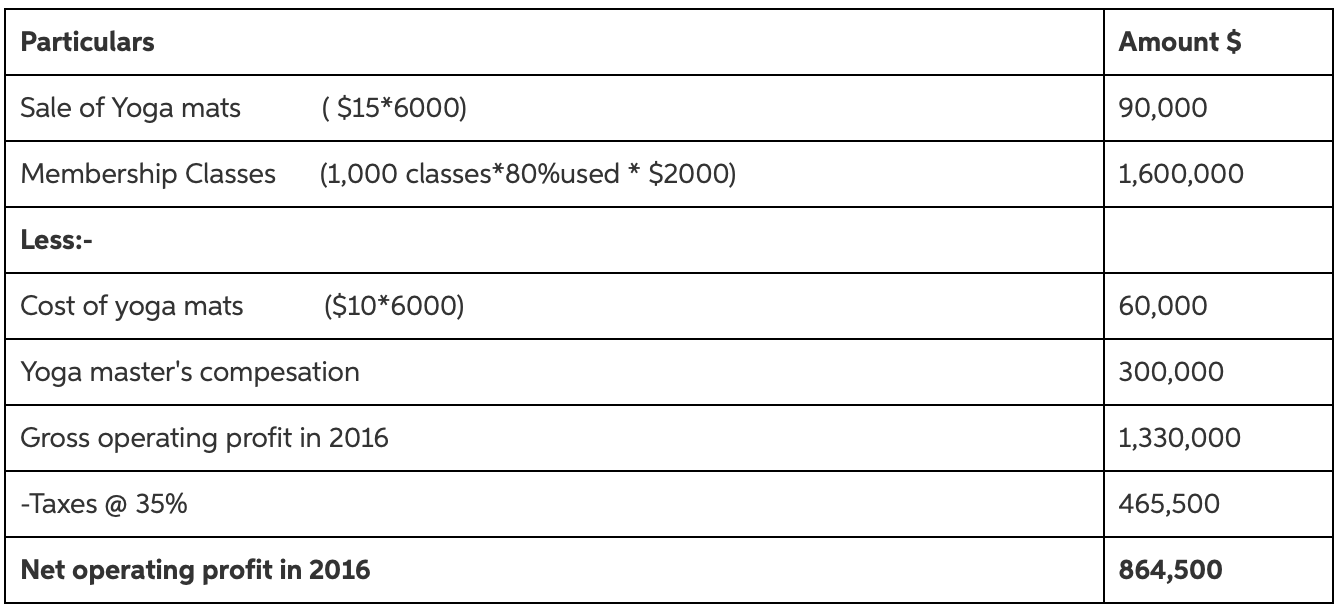

1. LuluYogas net operating profit in 2016 is 864,500

2. LuluYogas net operating profit in 2017 is 156,000:

Out of 10000 mats the company sold 6000 mats in 2016 and remaining 4000 mats will be sold in 2017 at $20 each.

Out of 1000 member ship passes 20% are used in 2017

The total revenue will be = (4000 * 20 + 200 * 2000) = $480,000

The cost will be (4000 * $10 + 200,000) = $240,000

Profit before tax (480k - 240K) = $240K

Profit after tax = 240,000*0.65 = $156K

3. The change of inventory from 2015 to 2016, and from 2016 to 2017 is +$40,000;-$40,000

4. the deferred revenue in 2016 is 400K

5. The FCF of LuluYoga in year 2016 is $1,224,500

MY QUESTION: WHAT IS THE CHANGE IN NOWC IN YEAR 2016?

Particulars Amount $ Sale of Yoga mats ( $15*6000) 90,000 Membership Classes (1,000 classes*80%used * $2000) 1,600,000 Less:- Cost of yoga mats ($10*6000) 60,000 Yoga master's compesation 300,000 Gross operating profit in 2016 1,330,000 -Taxes @ 35% 465,500 Net operating profit in 2016 864,500 Particulars Amount $ Sale of Yoga mats ( $15*6000) 90,000 Membership Classes (1,000 classes*80%used * $2000) 1,600,000 Less:- Cost of yoga mats ($10*6000) 60,000 Yoga master's compesation 300,000 Gross operating profit in 2016 1,330,000 -Taxes @ 35% 465,500 Net operating profit in 2016 864,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts