Question: you basically only need the information from the graph: rf= 5% mrp= 6% tax rate= 40% Walgreen Co is considering starting a home improvement stores

you basically only need the information from the graph:

rf= 5%

mrp= 6%

tax rate= 40%

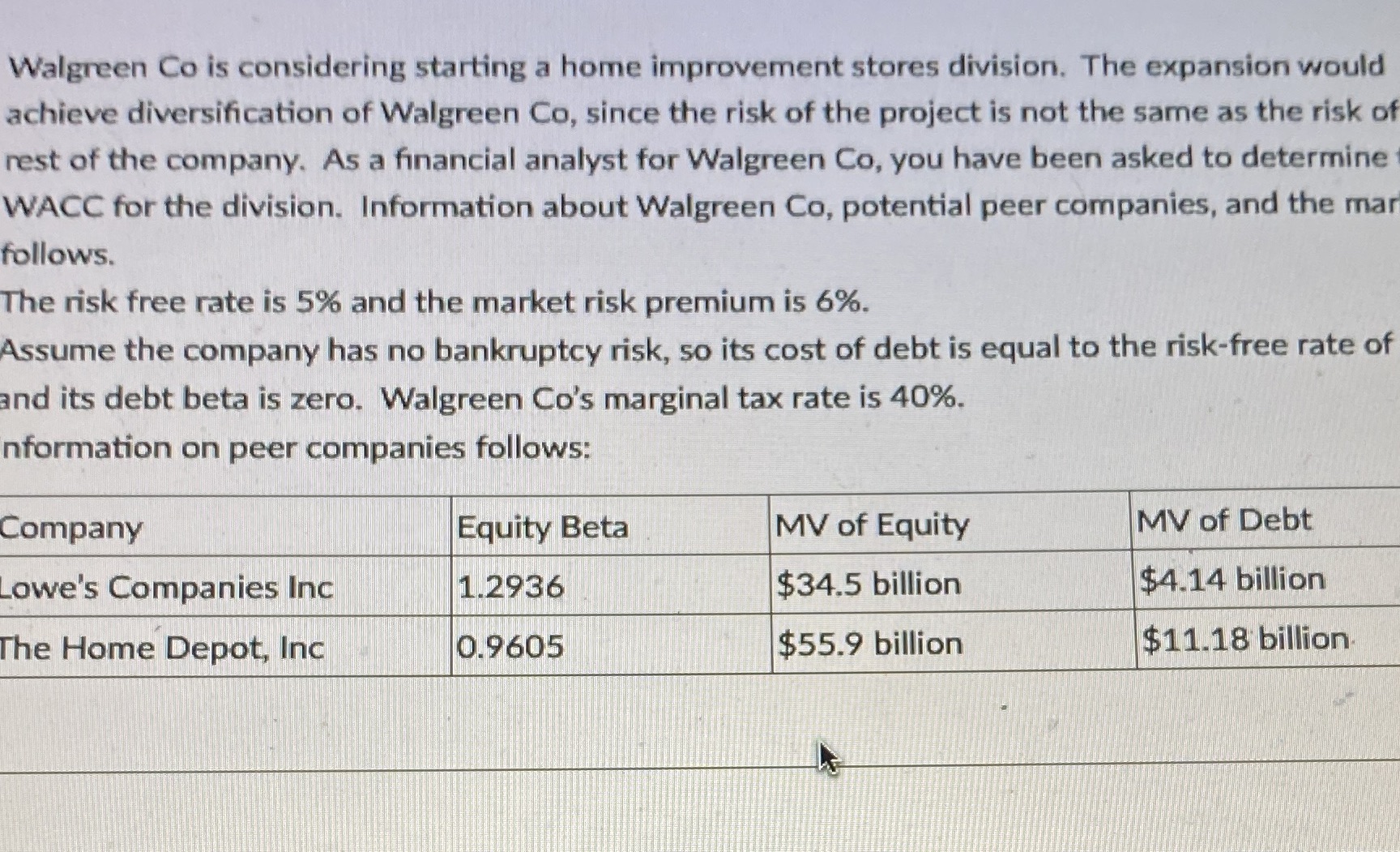

Walgreen Co is considering starting a home improvement stores division. The expansion would achieve diversification of Walgreen Co, since the risk of the project is not the same as the risk of rest of the company. As a financial analyst for Walgreen Co, you have been asked to determine WACC for the division. Information about Walgreen Co, potential peer companies, and the mar follows. The risk free rate is 5% and the market risk premium is 6%. Assume the company has no bankruptcy risk, so its cost of debt is equal to the risk-free rate of and its debt beta is zero. Walgreen Co's marginal tax rate is 40%. nformation on peer companies follows: Company Equity Beta MV of Equity MV of Debt Lowe's Companies Inc 1.2936 $34.5 billion $4.14 billion The Home Depot, Inc 0.9605 $55.9 billion $11.18 billion

Walgreen Co is considering starting a home improvement stores division. The expansion would achieve diversification of Walgreen Co, since the risk of the project is not the same as the risk of rest of the company. As a financial analyst for Walgreen Co, you have been asked to determine WACC for the division. Information about Walgreen Co, potential peer companies, and the mar follows. The risk free rate is 5% and the market risk premium is 6%. Assume the company has no bankruptcy risk, so its cost of debt is equal to the risk-free rate of and its debt beta is zero. Walgreen Co's marginal tax rate is 40%. nformation on peer companies follows: Company Equity Beta MV of Equity MV of Debt Lowe's Companies Inc 1.2936 $34.5 billion $4.14 billion The Home Depot, Inc 0.9605 $55.9 billion $11.18 billion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts