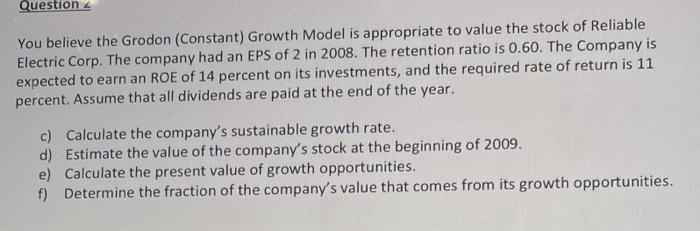

Question: You believe the Grodon (Constant) Growth Model is appropriate to value the stock of Reliable Electric Corp. The company had an EPS of 2 in

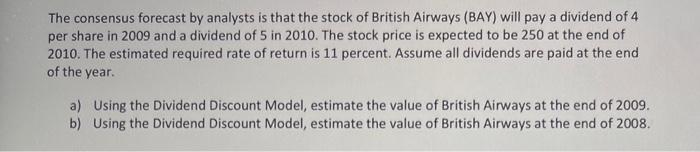

You believe the Grodon (Constant) Growth Model is appropriate to value the stock of Reliable Electric Corp. The company had an EPS of 2 in 2008. The retention ratio is 0.60. The Company is expected to earn an ROE of 14 percent on its investments, and the required rate of return is 11 percent. Assume that all dividends are paid at the end of the year. c) Calculate the company's sustainable growth rate. d) Estimate the value of the company's stock at the beginning of 2009. e) Calculate the present value of growth opportunities. f) Determine the fraction of the company's value that comes from its growth opportunities. The consensus forecast by analysts is that the stock of British Airways (BAY) will pay a dividend of 4 per share in 2009 and a dividend of 5 in 2010 . The stock price is expected to be 250 at the end of 2010. The estimated required rate of return is 11 percent. Assume all dividends are paid at the end of the year. a) Using the Dividend Discount Model, estimate the value of British Airways at the end of 2009. b) Using the Dividend Discount Model, estimate the value of British Airways at the end of 2008

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts