Question: You borrow $ 2 9 0 , 0 0 0 ; the annual loan payments are $ 1 4 , 7 9 5 . 5

You borrow $; the annual loan payments are $ for years. What interest

rate are you being charged? Round your answer to the nearest whole number.

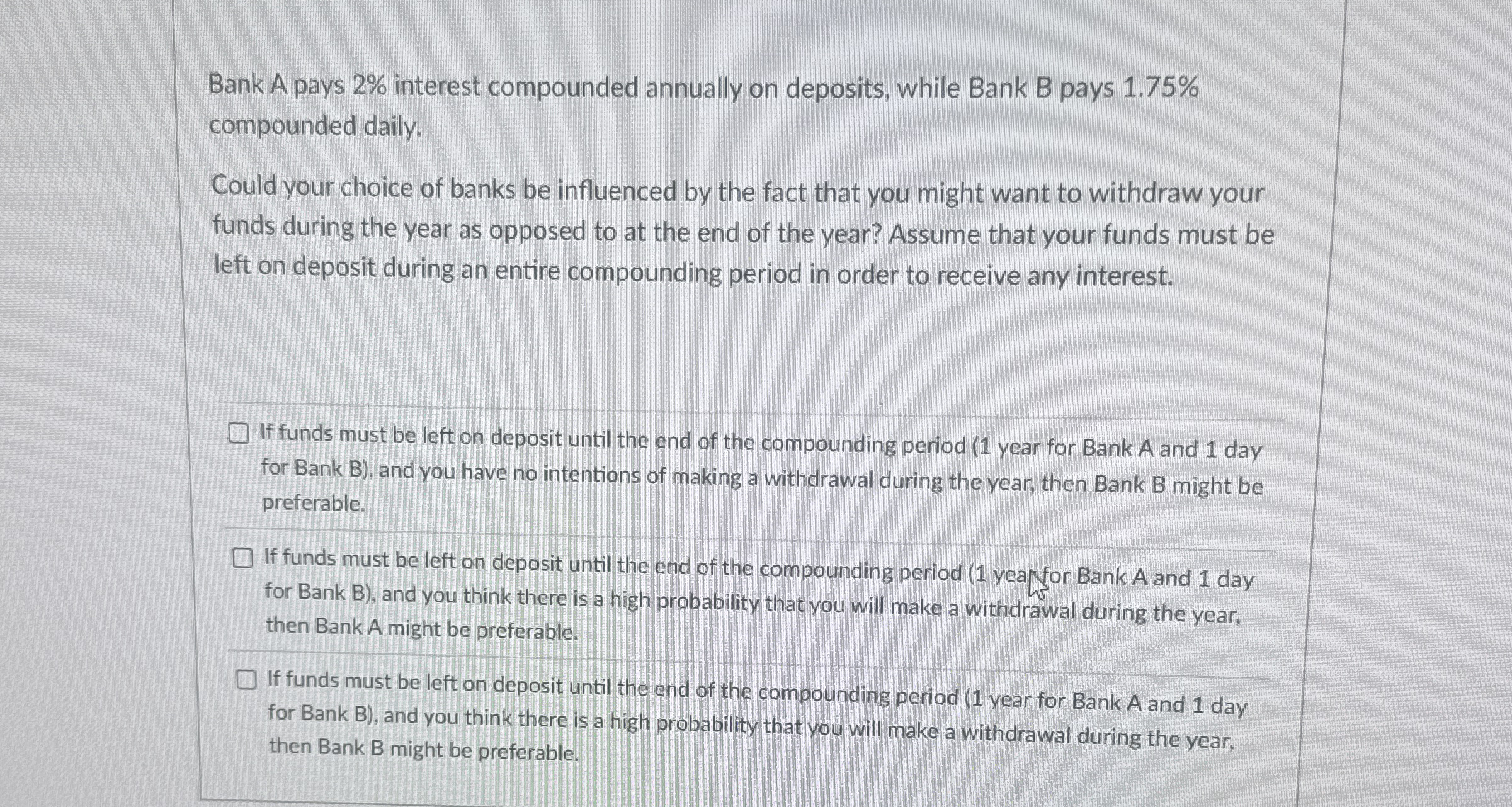

Bank A pays interest compounded annually on deposits, while Bank B pays

compounded daily.

Could your choice of banks be influenced by the fact that you might want to withdraw your

funds during the year as opposed to at the end of the year? Assume that your funds must be

left on deposit during an entire compounding period in order to receive any interest.

If funds must be left on deposit until the end of the compounding period year for Bank A and day

for Bank B and you have no intentions of making a withdrawal during the year, then Bank B might be

preferable.

If funds must be left on deposit until the end of the compounding period yearfor Bank A and day

for Bank B and you think there is a high probability that you will make a withdrawal during the year,

then Bank A might be preferable.

If funds must be left on deposit until the end of the compounding period year for Bank A and day

for Bank B and you think there is a high probability that you will make a withdrawal during the year,

then Bank B might be preferable.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock