Question: You borrow money on a self liquidating installment loan (equal payments at the end of each year, each payment is part principal part interest)

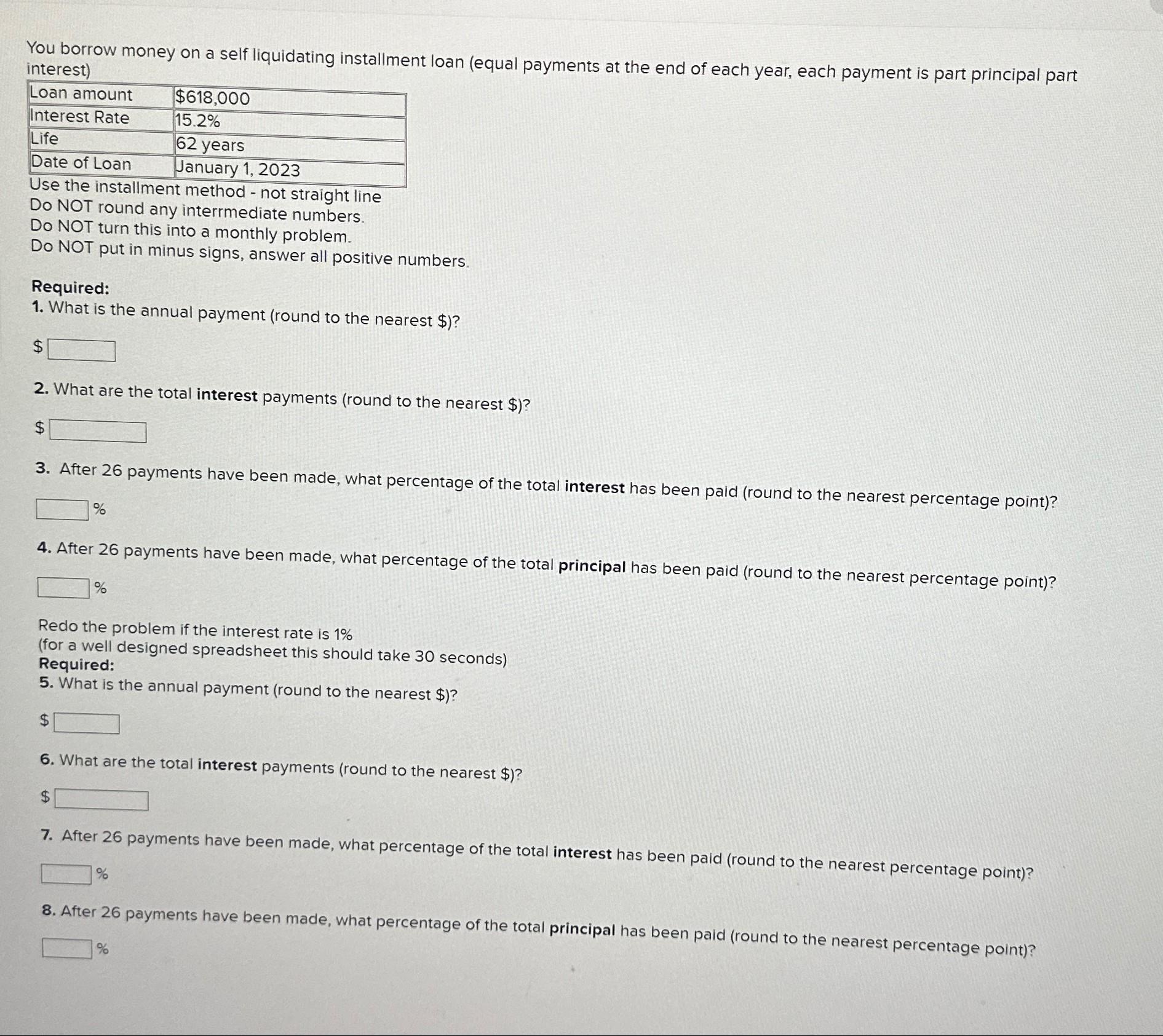

You borrow money on a self liquidating installment loan (equal payments at the end of each year, each payment is part principal part interest) Loan amount Interest Rate Life Date of Loan $618,000 15.2% 62 years January 1, 2023 Use the installment method - not straight line Do NOT round any interrmediate numbers. Do NOT turn this into a monthly problem. Do NOT put in minus signs, answer all positive numbers. Required: 1. What is the annual payment (round to the nearest $)? $ 2. What are the total interest payments (round to the nearest $)? $ 3. After 26 payments have been made, what percentage of the total interest has been paid (round to the nearest percentage point)? % 4. After 26 payments have been made, what percentage of the total principal has been paid (round to the nearest percentage point)? % Redo the problem if the interest rate is 1% (for a well designed spreadsheet this should take 30 seconds) Required: 5. What is the annual payment (round to the nearest $)? $ 6. What are the total interest payments (round to the nearest $)? $ 7. After 26 payments have been made, what percentage of the total interest has been paid (round to the nearest percentage point)? % 8. After 26 payments have been made, what percentage of the total principal has been paid (round to the nearest percentage point)? %

Step by Step Solution

There are 3 Steps involved in it

To solve this problem we will use the installment method to calculate the annual payment total interest payments percentage of total interest paid aft... View full answer

Get step-by-step solutions from verified subject matter experts