Question: You boss needs help again. With the partial model please forecast Ziebers 2017 income statement and balance sheets. Use the following assumptions: (1) Sales grow

You boss needs help again.

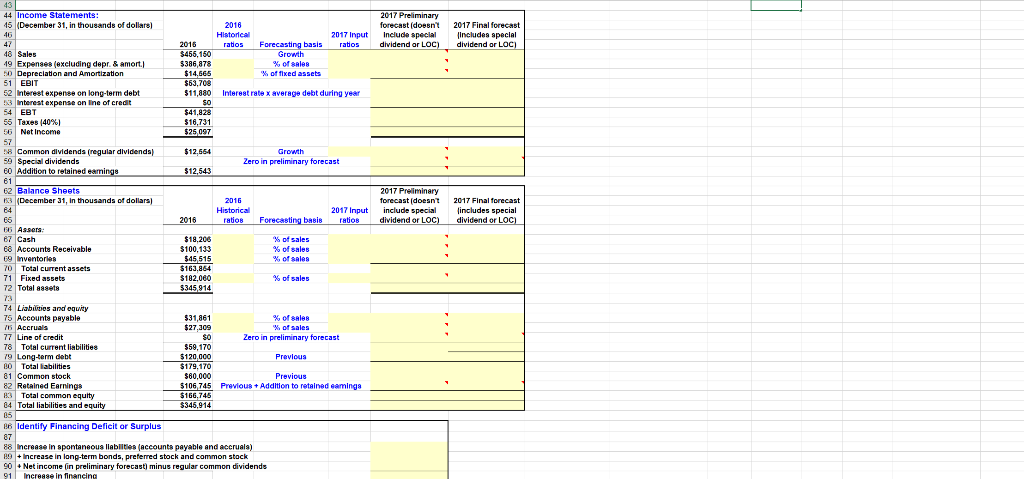

With the partial model please forecast Ziebers 2017 income statement and balance sheets. Use the following assumptions: (1) Sales grow by 6%. (2) The ratios of expenses to sales, depreciation to fixed assets, cash to sales, accounts receivable to sales, and inventories to sales will be the same in 2017 as in 2016. (3) Zieber will not issue any new stock or new long-term bonds. (4) The interest rate is 11% for long- term debt and the interest expense on long-term debt is based on the average balance during the year. (5) No interest is earned on cash. (6) Regular dividends grow at an 8% rate. Calculate the additional funds needed (AFN). If new financing is required, assume it will be raised by drawing on a line of credit with an interest rate of 12%. Assume that any draw on the line of credit will be made on the last day of the year, so there will be no additional interest expense for the new line of credit. If surplus funds are available, pay a special dividend.

- What are the forecasted levels of the line of credit and special dividends? (Hints: Create a column showing the ratios for the current year; then create a new column showing the ratios used in the forecast. Also, create a preliminary forecast that doesnt include any new line of credit or special dividends. Identify the financing deficit or surplus in this preliminary forecast and then add a new column that shows the final forecast that includes any new line of credit or special dividend.)

- Now assume that the growth in sales is only 3%. What are the forecasted levels of the line of credit and special dividends?

44 Income Statements: 5 (December 31, in thousands of dollars 2017 Preliminary forecast (doen2017 Final forecast 2017 Input Indlude special ncludes special 2016 ratios Forecasting basis ratiosdividend ar 48 Sales 19 Expen8e8 (exeluding depr. & amort. $455,150 5386,878 14,665 $63,708 11,880 Depreciation and Amortization 51 EBIT 52 Interest expense on long-term debt 3 Interest expense on Ine of credit 54 EBT 55 Taxes 40%) 5 Net Income % of fixed assets Interest rate x average debt during year $41,828 $16,731 $25,097 12,564 8 Common dividends (reguiar dividenda 9 Special dividends 60 Addition to retained 2ero in preliminary forecast $12,543 62 Balance Sheets 3 December 31, in thousands of dollars forecast [doesnt 2017 Final forecast include special includes special 2017 Input basis rat dividend or L dividend or $18,206 $100,133 87 Cash 68 Accounts Receivable 69 Inventories 0 Total current assets 71 Fixed assets 72 Total 88set8 % of sales % of sales $163,864 $182,060 5345,914 % of sales 4 Liabiies and equity 75 Accounts payable 531,861 27,309 Accruals 77 Line of credit 78 Total current liabilities 9 Long-term debt 00Total labilities 81 Common stock 82 Retained Earnings 3Total common equity 84 Total liabilities and 2ero in preliminary forecast $59,170 $120,000 $179,170 $60,000 106745 PreviousAddition to retained eaminga $345,914 8B Identify Financing Deficit or Surplus 88 Increase in spontaneous llablitdes (accounts payable and accruala) Increase in long-term bonds, pretered stock and common stock 0Net income (in preliminary forecast) minus regular common dividends 44 Income Statements: 5 (December 31, in thousands of dollars 2017 Preliminary forecast (doen2017 Final forecast 2017 Input Indlude special ncludes special 2016 ratios Forecasting basis ratiosdividend ar 48 Sales 19 Expen8e8 (exeluding depr. & amort. $455,150 5386,878 14,665 $63,708 11,880 Depreciation and Amortization 51 EBIT 52 Interest expense on long-term debt 3 Interest expense on Ine of credit 54 EBT 55 Taxes 40%) 5 Net Income % of fixed assets Interest rate x average debt during year $41,828 $16,731 $25,097 12,564 8 Common dividends (reguiar dividenda 9 Special dividends 60 Addition to retained 2ero in preliminary forecast $12,543 62 Balance Sheets 3 December 31, in thousands of dollars forecast [doesnt 2017 Final forecast include special includes special 2017 Input basis rat dividend or L dividend or $18,206 $100,133 87 Cash 68 Accounts Receivable 69 Inventories 0 Total current assets 71 Fixed assets 72 Total 88set8 % of sales % of sales $163,864 $182,060 5345,914 % of sales 4 Liabiies and equity 75 Accounts payable 531,861 27,309 Accruals 77 Line of credit 78 Total current liabilities 9 Long-term debt 00Total labilities 81 Common stock 82 Retained Earnings 3Total common equity 84 Total liabilities and 2ero in preliminary forecast $59,170 $120,000 $179,170 $60,000 106745 PreviousAddition to retained eaminga $345,914 8B Identify Financing Deficit or Surplus 88 Increase in spontaneous llablitdes (accounts payable and accruala) Increase in long-term bonds, pretered stock and common stock 0Net income (in preliminary forecast) minus regular common dividends

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts