Question: 1-What is the yield to maturity of a bond that pays a 10% coupon rate with semi-annual coupon payments, has a par value of

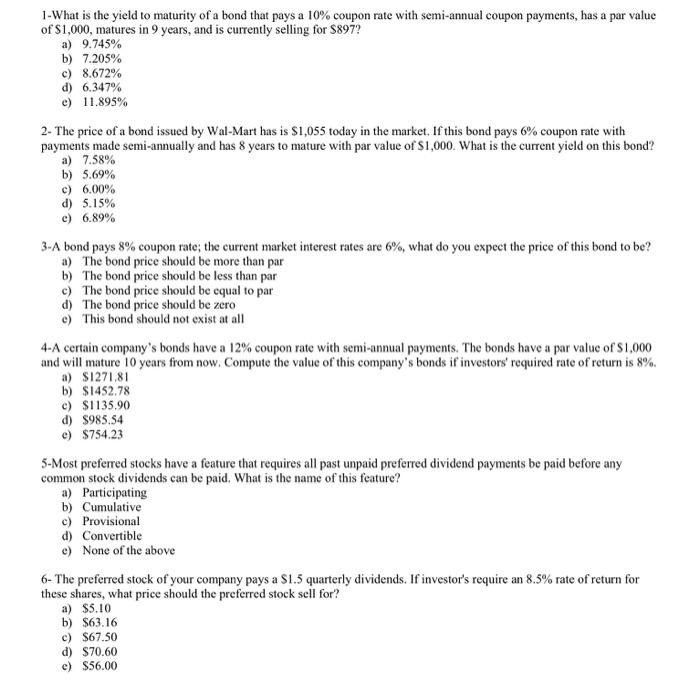

1-What is the yield to maturity of a bond that pays a 10% coupon rate with semi-annual coupon payments, has a par value of $1,000, matures in 9 years, and is currently selling for $897? a) 9.745% b) 7.205% c) 8.672% d) 6.347% e) 11.895% 2- The price of a bond issued by Wal-Mart has is $1,055 today in the market. If this bond pays 6% coupon rate with payments made semi-annually and has 8 years to mature with par value of $1,000. What is the current yield on this bond? a) 7.58% b) 5.69% c) 6.00% d) 5.15% c) 6.89% 3-A bond pays 8% coupon rate; the current market interest rates are 6%, what do you expect the price of this bond to be? a) The bond price should be more than par b) The bond price should be less than par c) The bond price should be equal to par d) The bond price should be zero e) This bond should not exist at all 4-A certain company's bonds have a 12% coupon rate with semi-annual payments. The bonds have a par value of $1,000 and will mature 10 years from now. Compute the value of this company's bonds if investors' required rate of return is 8%. a) $1271.81 b) $1452.78 c) $1135.90 d) $985.54 e) $754.23 5-Most preferred stocks have a feature that requires all past unpaid preferred dividend payments be paid before any common stock dividends can be paid. What is the name of this feature? a) Participating b) Cumulative c) Provisional d) Convertible e) None of the above 6- The preferred stock of your company pays a $1.5 quarterly dividends. If investor's require an 8.5% rate of return for these shares, what price should the preferred stock sell for? a) $5.10 b) $63.16 c) $67.50 d) $70.60 e) $56.00

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

1c 2c 3b 4e 5d 6c 1 The yield to maturity of a bond that pays a 10 coupon rate with semiannual coupo... View full answer

Get step-by-step solutions from verified subject matter experts