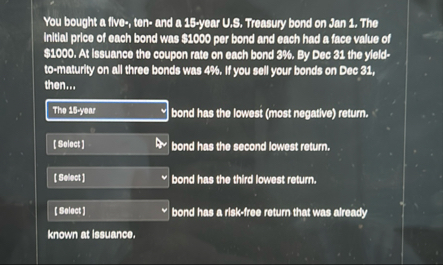

Question: You bought a flvo - , ton - and a 1 5 - year U . S . Treasury bond on Jan 1 . The

You bought a flvo ton and a year US Treasury bond on Jan The Initial price of each bond was $ per bond and each had a face value of $ At issuance the coupon rate on each bond By Dec the yleldtomaturily on all three bonds was II you sell your bonds on Dec then...

bond has the lowest most negative return.

bond has the second lowest return.

bond has the third lowest return.

bond has a riskfree return that was already known at issuance.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock