Question: You buy a 30 year zero coupon bond which will pay you $10,000 in 30 years at an annual yield of i=1% compounded once

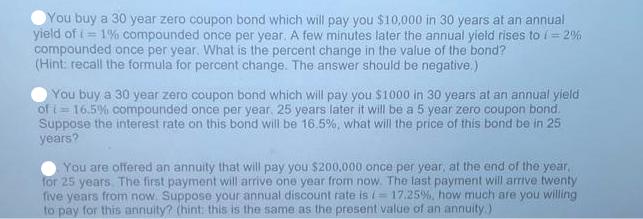

You buy a 30 year zero coupon bond which will pay you $10,000 in 30 years at an annual yield of i=1% compounded once per year. A few minutes later the annual yield rises to (= 2% compounded once per year. What is the percent change in the value of the bond? (Hint: recall the formula for percent change. The answer should be negative.) You buy a 30 year zero coupon bond which will pay you $1000 in 30 years at an annual yield of i=16.5% compounded once per year. 25 years later it will be a 5 year zero coupon bond. Suppose the interest rate on this bond will be 16.5%, what will the price of this bond be in 25 years? You are offered an annuity that will pay you $200,000 once per year, at the end of the year, for 25 years. The first payment will arrive one year from now. The last payment will arrive twenty five years from now. Suppose your annual discount rate is / 17.25%, how much are you willing to pay for this annuity? (hint: this is the same as the present value of an annuity.)

Step by Step Solution

There are 3 Steps involved in it

Answers To solve these finance problems well use the formulas for present value and percent change 1 Percent change in the value of the bond The formula for percent change is given by Percent Change N... View full answer

Get step-by-step solutions from verified subject matter experts