Question: You can find the data for this problem in the Excel file. In the file, you can find a list of securities, along with their

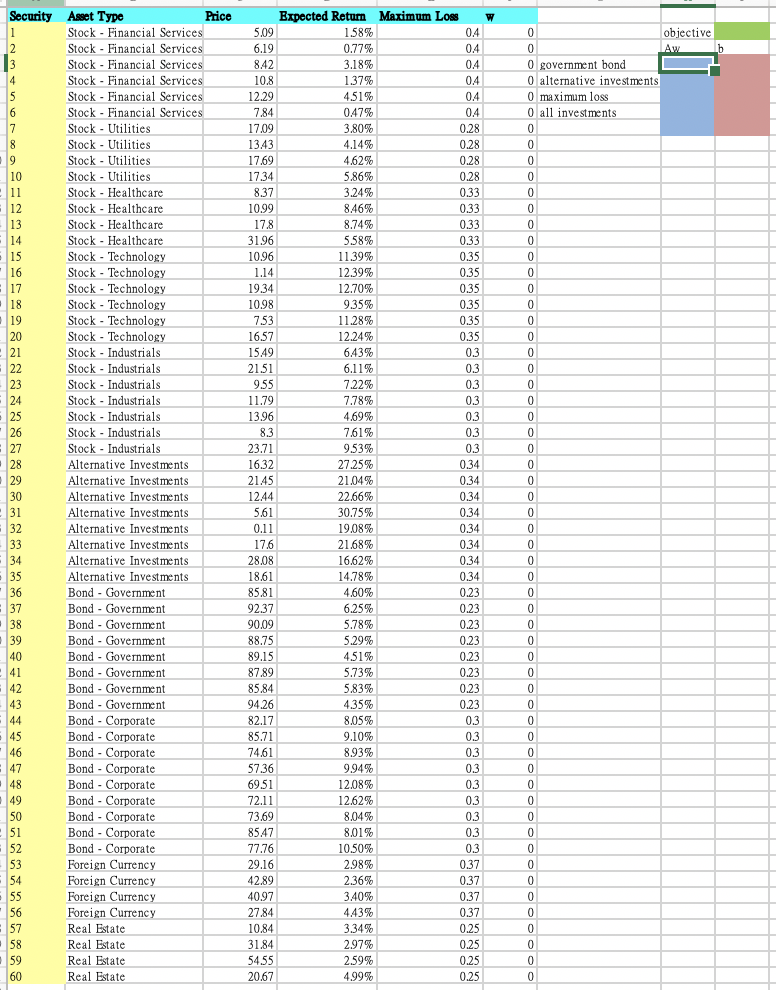

You can find the data for this problem in the Excel file. In the file, you can find a list of securities, along with their given attributes: asset type, price, expected return, and maximum loss per dollar invested (guaranteed by your broker). Assume that you are given an endowment of $100 to invest in these securities, and that you can invest in any fraction of any asset.

Write a linear program in vector notation to allocate your endowment in the securities to maximize the expected return of your portfolio, and such that

At least 40% of the portfolio (dollars invested) are in government bonds;

No more than 10% of the portfolio (dollars invested) be in alternative investments;

The maximum allowable loss of the portfolio is 30%;

Due to the recent financial meltdown, you are not allowed to short sell any security (invest in a negative amount).

solve using exce.

Security Maximum Loss objective O government bond 0 alternative investments O maximum loss 0 all investments 0.28 0.28 0.28 0.28 0.33 0.33 0.33 0.33 0.35 0.35 0.35 0.35 0.35 0.35 Asset Type Price Stock - Financial Services Stock - Financial Services Stock - Financial Services Stock - Financial Services Stock - Financial Services Stock - Financial Services Stock - Utilities Stock - Utilities Stock - Utilities Stock - Utilities Stock - Healthcare Stock - Healthcare Stock - Healthcare Stock - Healthcare Stock - Technology Stock - Technology Stock - Technology Stock - Technology Stock - Technology Stock - Technology Stock - Industrials Stock - Industrials Stock - Industrials Stock - Industrials Stock - Industrials Stock - Industrials Stock - Industrials Alternative Investments Alternative Investments Alternative Investments Alternative Investments Alternative Investments Alternative Investments Alternative Investments Alternative Investments Bond - Government Bond - Government Bond - Government Bond - Government Bond - Government Bond - Government Bond - Government Bond - Government Bond - Corporate Bond - Corporate Bond - Corporate Bond - Corporate Bond - Corporate Bond - Corporate Bond - Corporate Bond - Corporate Bond - Corporate Foreign Currency Foreign Currency Foreign Currency Foreign Currency Real Estate Real Estate Real Estate Real Estate Expected Retum 5.09 1.58% 6.19 0.77% 8.42 3.18% 10.8 1.37% 12.29 4.51% 7.84 0.47% 17.09 3.80% 1343 4.14% 17.69 4.62% 17.34 5.86% 8.37 3.24% 1099 8.46% 17.8 8.74% 31.96 5.58% 10.96 11.39% 1.14 12.39% 19.34 12.70% 10.98 9.35% 7.53 11.28% 16.57 12.24% 15:49 6,43% 21.51 6.11% 9.55 7.22% 11.79 7.78% 13.96 4.69% 8.3 7.61% 23.71 9.53% 16.32 27.25% 21.45 21.04% 12.44 22.66% 5.61 30.75% 0.11 19.08% 17.6 21.68% 28.08 16.62% 18.61 14.78% 85.81 4.60% 92.37 6.25% 90.09 5.78% 88.75 5.29% 89.15 4.51% 87.89 5.73% 85.84 5.83% 94.26 4.35% 82.17 8.05% 85.71 9.10% 74.61 8.93% 57.36 9.94% 69.51 12.08% 72.11 12.62% 73.69 8.04% 85.47 8.01% 77.76 10.50% 29.16 2.98% 42.89 2.36% 40.97 3.40% 27.84 4.43% 10.84 3.34% 31.84 2.97% 54.55 2.59% 20.67 4.99% 0.37 0.37 0.37 0.37 0.25 0.25 0.25 0.25 Security Maximum Loss objective O government bond 0 alternative investments O maximum loss 0 all investments 0.28 0.28 0.28 0.28 0.33 0.33 0.33 0.33 0.35 0.35 0.35 0.35 0.35 0.35 Asset Type Price Stock - Financial Services Stock - Financial Services Stock - Financial Services Stock - Financial Services Stock - Financial Services Stock - Financial Services Stock - Utilities Stock - Utilities Stock - Utilities Stock - Utilities Stock - Healthcare Stock - Healthcare Stock - Healthcare Stock - Healthcare Stock - Technology Stock - Technology Stock - Technology Stock - Technology Stock - Technology Stock - Technology Stock - Industrials Stock - Industrials Stock - Industrials Stock - Industrials Stock - Industrials Stock - Industrials Stock - Industrials Alternative Investments Alternative Investments Alternative Investments Alternative Investments Alternative Investments Alternative Investments Alternative Investments Alternative Investments Bond - Government Bond - Government Bond - Government Bond - Government Bond - Government Bond - Government Bond - Government Bond - Government Bond - Corporate Bond - Corporate Bond - Corporate Bond - Corporate Bond - Corporate Bond - Corporate Bond - Corporate Bond - Corporate Bond - Corporate Foreign Currency Foreign Currency Foreign Currency Foreign Currency Real Estate Real Estate Real Estate Real Estate Expected Retum 5.09 1.58% 6.19 0.77% 8.42 3.18% 10.8 1.37% 12.29 4.51% 7.84 0.47% 17.09 3.80% 1343 4.14% 17.69 4.62% 17.34 5.86% 8.37 3.24% 1099 8.46% 17.8 8.74% 31.96 5.58% 10.96 11.39% 1.14 12.39% 19.34 12.70% 10.98 9.35% 7.53 11.28% 16.57 12.24% 15:49 6,43% 21.51 6.11% 9.55 7.22% 11.79 7.78% 13.96 4.69% 8.3 7.61% 23.71 9.53% 16.32 27.25% 21.45 21.04% 12.44 22.66% 5.61 30.75% 0.11 19.08% 17.6 21.68% 28.08 16.62% 18.61 14.78% 85.81 4.60% 92.37 6.25% 90.09 5.78% 88.75 5.29% 89.15 4.51% 87.89 5.73% 85.84 5.83% 94.26 4.35% 82.17 8.05% 85.71 9.10% 74.61 8.93% 57.36 9.94% 69.51 12.08% 72.11 12.62% 73.69 8.04% 85.47 8.01% 77.76 10.50% 29.16 2.98% 42.89 2.36% 40.97 3.40% 27.84 4.43% 10.84 3.34% 31.84 2.97% 54.55 2.59% 20.67 4.99% 0.37 0.37 0.37 0.37 0.25 0.25 0.25 0.25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts