Question: You can leave this tab open while you answer the question. Question 33 (5 points) On September 19. you instruct your broker to buy as

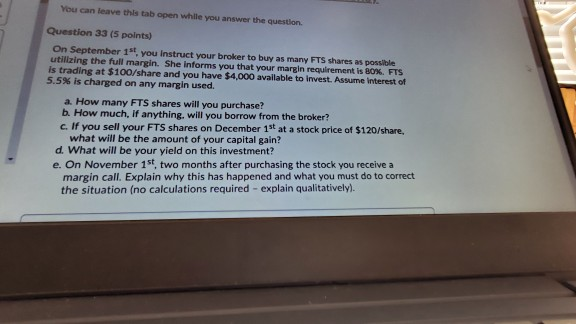

You can leave this tab open while you answer the question. Question 33 (5 points) On September 19. you instruct your broker to buy as many FTS shares as possible utilizing the full margin. She informs you that your margin requirement is 80%. FTS is trading at $100/share and you have $4,000 available to invest. Assume interest of 5.5% is charged on any margin used. a. How many FTS shares will you purchase? b. How much, if anything will you borrow from the broker? c. If you sell your FTS shares on December 19t at a stock price of $120/share, what will be the amount of your capital gain? d. What will be your yield on this investment? e. On November 1st two months after purchasing the stock you receive a margin call. Explain why this has happened and what you must do to correct the situation (no calculations required - explain qualitatively)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts