Question: . YOU CAN SHOW YOUR ANSWER (WITH PROCEDURE) AFTER EACH QUESTION USING THIS WORD TEMPLATE. (Write your name and ID at the top of this

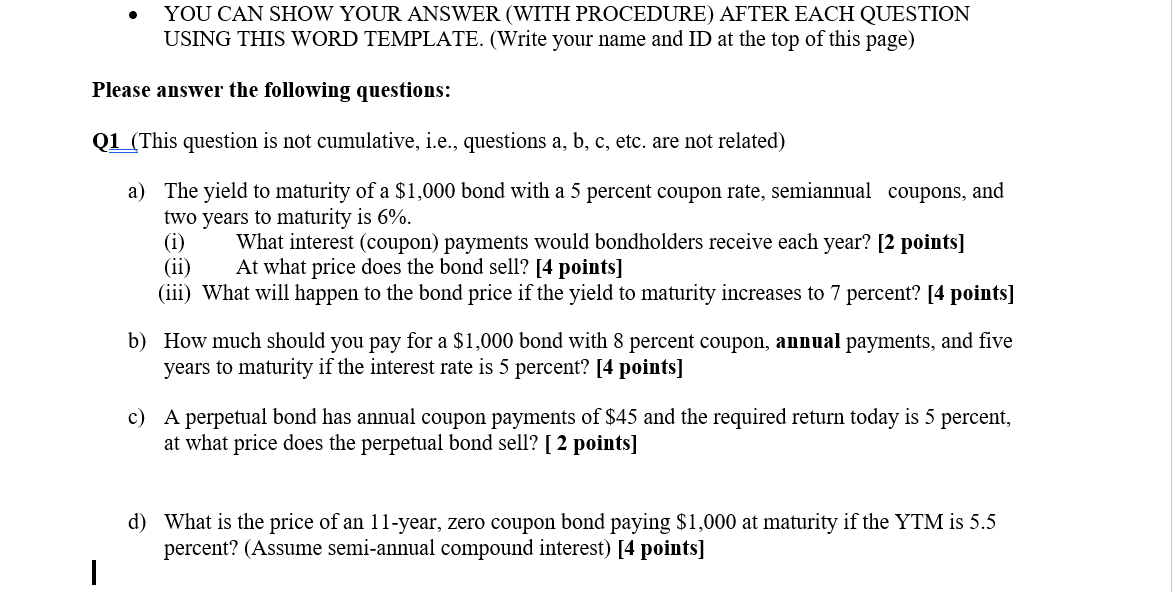

. YOU CAN SHOW YOUR ANSWER (WITH PROCEDURE) AFTER EACH QUESTION USING THIS WORD TEMPLATE. (Write your name and ID at the top of this page) Please answer the following questions: Q1 (This question is not cumulative, i.e., questions a, b, c, etc. are not related) a) The yield to maturity of a $1,000 bond with a 5 percent coupon rate, semiannual coupons, and two years to maturity is 6%. (i) What interest (coupon) payments would bondholders receive each year? [2 points] (ii) At what price does the bond sell? [4 points] (iii) What will happen to the bond price if the yield to maturity increases to 7 percent? [4 points] b) How much should you pay for a $1,000 bond with 8 percent coupon, annual payments, and five years to maturity if the interest rate is 5 percent? [4 points] c) A perpetual bond has annual coupon payments of $45 and the required return today is 5 percent, at what price does the perpetual bond sell? [ 2 points] d) What is the price of an 11-year, zero coupon bond paying $1,000 at maturity if the YTM is 5.5 percent? (Assume semi-annual compound interest) [4 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts