Question: you can skip number (1) because is already solved Question 1: Answer the following questions: (1 mark for each) 1. Ghadah plans to invest $70,000.

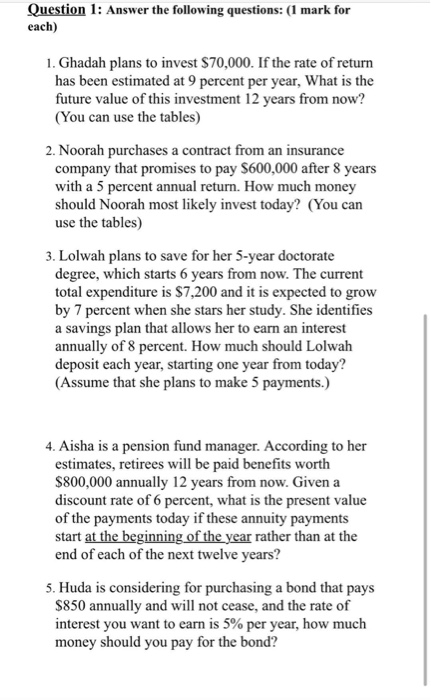

Question 1: Answer the following questions: (1 mark for each) 1. Ghadah plans to invest $70,000. If the rate of return has been estimated at 9 percent per year, What is the future value of this investment 12 years from now? (You can use the tables) 2. Noorah purchases a contract from an insurance company that promises to pay $600,000 after 8 years with a 5 percent annual return. How much money should Noorah most likely invest today? (You can use the tables) 3. Lolwah plans to save for her 5-year doctorate degree, which starts 6 years from now. The current total expenditure is $7,200 and it is expected to grow by 7 percent when she stars her study. She identifies a savings plan that allows her to earn an interest annually of 8 percent. How much should Lolwah deposit each year, starting one year from today? (Assume that she plans to make 5 payments.) 4. Aisha is a pension fund manager. According to her estimates, retirees will be paid benefits worth $800,000 annually 12 years from now. Given a discount rate of 6 percent, what is the present value of the payments today if these annuity payments start at the beginning of the year rather than at the end of each of the next twelve years? 5. Huda is considering for purchasing a bond that pays $850 annually and will not cease, and the rate of interest you want to earn is 5% per year, how much money should you pay for the bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts