Question: You can upload just one file that includes the required information for all three questions if you wish or you can upload separate files for

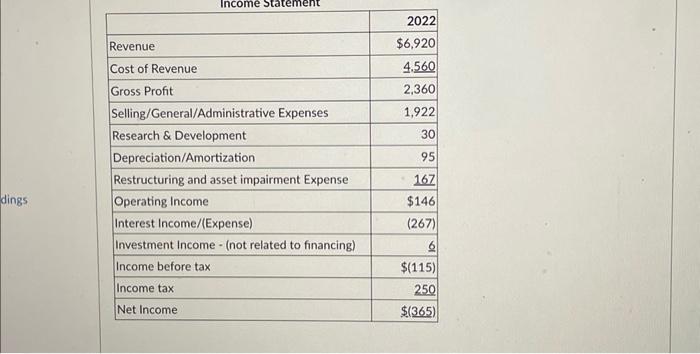

You can upload just one file that includes the required information for all three questions if you wish or you can upload separate files for each question. YOU MUST INCLUDE YOUR WORK (CALCULATIONS) TO RECEIVE CREDIT and this MUST be submitted in EXCEL. You will receive 1/2 credit for using the template you created Question \#3 of 3 Attached are XYZ's balance sheet and income statement, in millions. Dividends on Common Shares were $100 million for 2022 . Additional Information: - The other current assets, other long-term assets, other current liabilities, and other long-term liabilities have no interest-bearing accounts (they are all operating) - Cash \& Short-Term Investments - 2% of Revenue is operating, the rest is financing - Deferred taxes are operating - The long-term investments are investments in subsidiaries that are essential to the operations of the business. Therefore, these are not financing assets. - The investment income on the income statement is related to these subsidiaries. - The marginal tax rate is 21% For 2022, calculate the following: A. Net Operating income (NOPAT) \begin{tabular}{|l|r|} \hline & 2022 \\ \hline Revenue & $6,920 \\ \hline Cost of Revenue & 4.560 \\ \hline Gross Profit & 2,360 \\ \hline Selling/General/Administrative Expenses & 1,922 \\ \hline Research \& Development & 30 \\ \hline Depreciation/Amortization & 95 \\ \hline Restructuring and asset impairment Expense & 167 \\ \hline Operating Income & $146 \\ \hline Interest Income/(Expense) & (267) \\ \hline Investment Income - (not related to financing) & 6 \\ \hline Income before tax & $(115) \\ \hline Income tax & 250 \\ \hline Net Income & $(365) \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts