Question: You can use excel to complete this question. LRI Problem POS-54 Today ('time 0) XYZ stock trades at $28 per share. There exists a standard

You can use excel to complete this question.

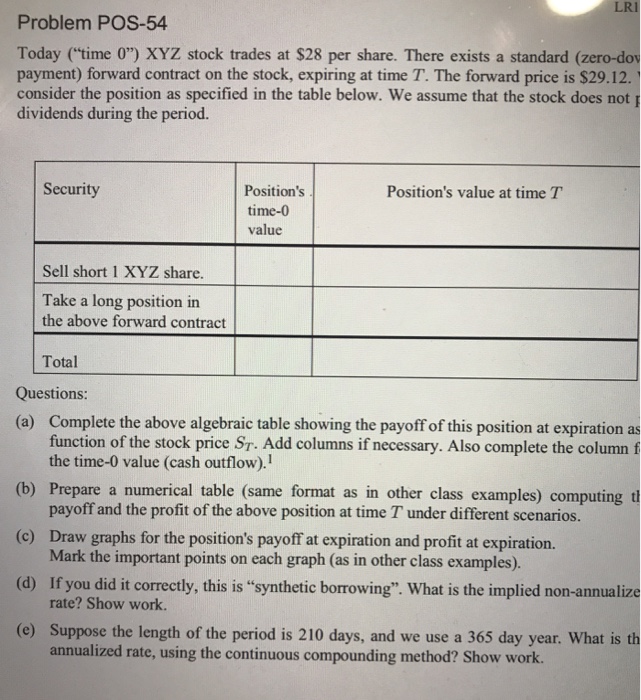

You can use excel to complete this question. LRI Problem POS-54 Today ('time 0") XYZ stock trades at $28 per share. There exists a standard (zero-dov payment) forward contract on the stock, expiring at time T. The forward price is $29.12. consider the position as specified in the table below. We assume that the stock does not dividends during the period. Security Position's time-0 value Position's value at time T Sell short 1 XYZ share. Take a long position in the above forward contract Total Questions: (a) Complete the above algebraic table showing the payoff of this position at expiration as function of the stock price Sr. Add columns if necessary. Also complete the columnf (b) Prepare a numerical table (same format as in other class examples) computing t (c) Draw graphs for the position's payoff at expiration and profit at expiration. (d) If you did it correctly, this is "synthetic borrowing". What is the implied non-annualiz (e) Suppose the length of the period is 210 days, and we use a 365 day year. What is th the time-0 value (cash outflow).1 payoff and the profit of the above position at time T under different scenarios. Mark the important points on each graph (as in other class examples). rate? Show work. annualized rate, using the continuous compounding method? Show work. LRI Problem POS-54 Today ('time 0") XYZ stock trades at $28 per share. There exists a standard (zero-dov payment) forward contract on the stock, expiring at time T. The forward price is $29.12. consider the position as specified in the table below. We assume that the stock does not dividends during the period. Security Position's time-0 value Position's value at time T Sell short 1 XYZ share. Take a long position in the above forward contract Total Questions: (a) Complete the above algebraic table showing the payoff of this position at expiration as function of the stock price Sr. Add columns if necessary. Also complete the columnf (b) Prepare a numerical table (same format as in other class examples) computing t (c) Draw graphs for the position's payoff at expiration and profit at expiration. (d) If you did it correctly, this is "synthetic borrowing". What is the implied non-annualiz (e) Suppose the length of the period is 210 days, and we use a 365 day year. What is th the time-0 value (cash outflow).1 payoff and the profit of the above position at time T under different scenarios. Mark the important points on each graph (as in other class examples). rate? Show work. annualized rate, using the continuous compounding method? Show work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts