Question: You can write down your answers in this format: After 10 successful years, Merchants International is considering going through the process of becoming a Corporation

You can write down your answers in this format:

You can write down your answers in this format:

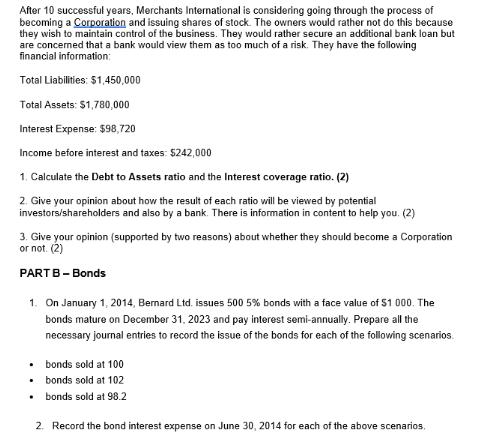

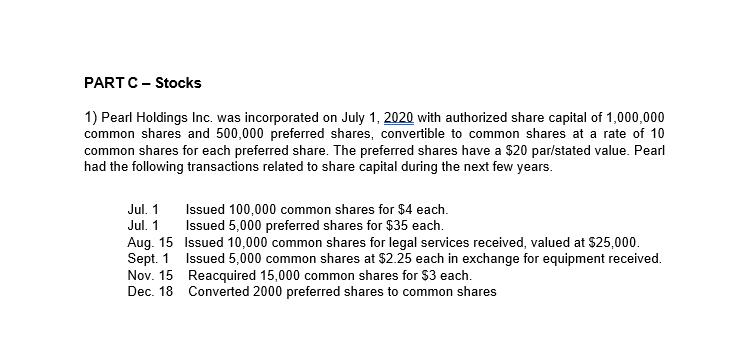

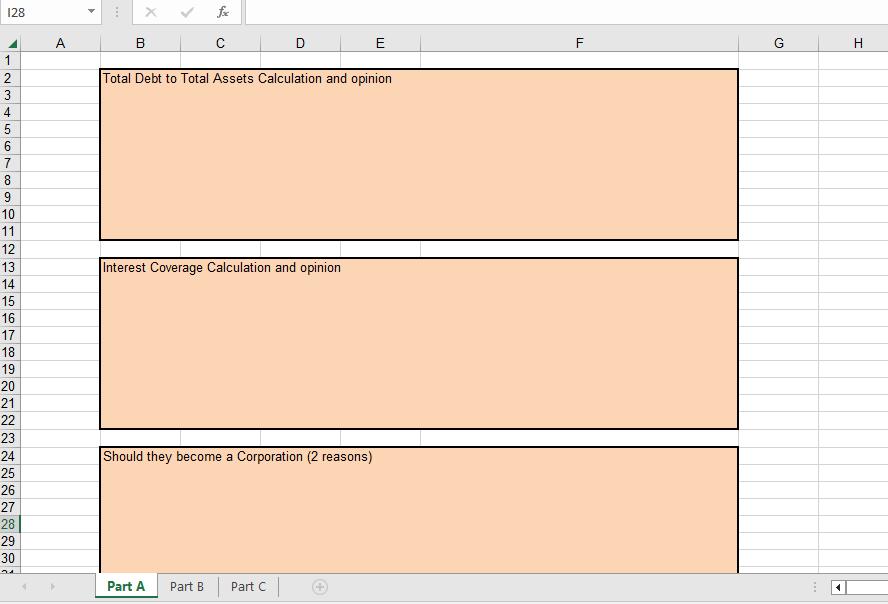

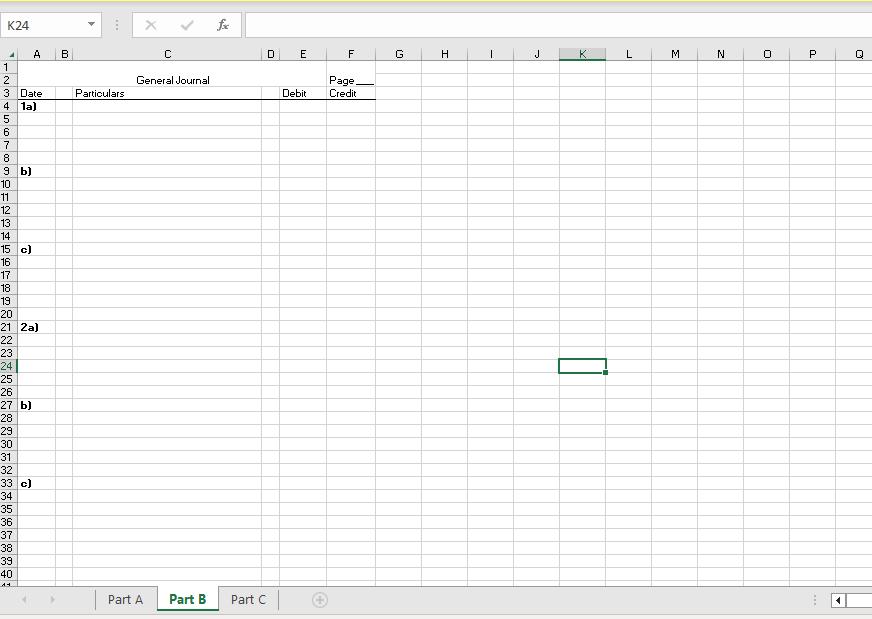

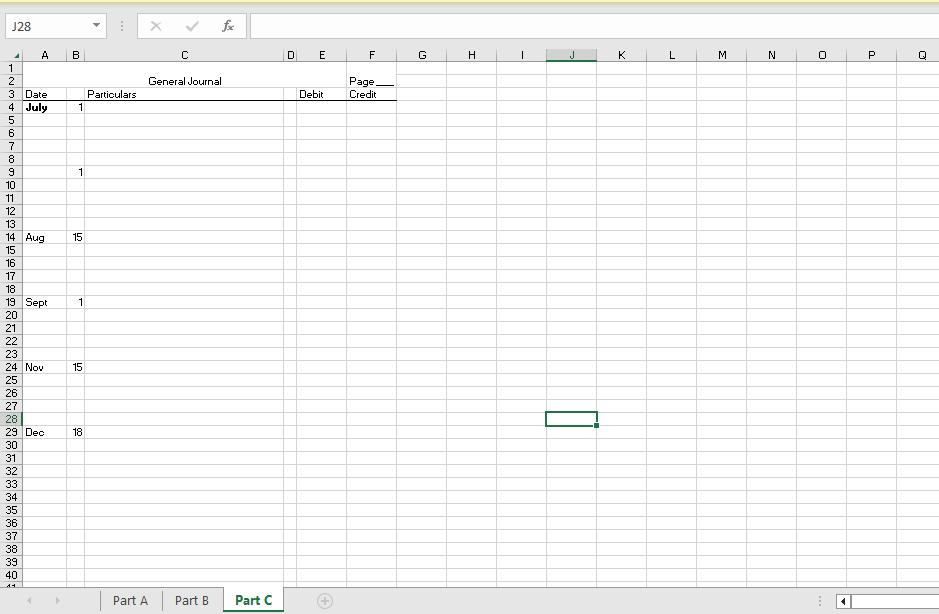

After 10 successful years, Merchants International is considering going through the process of becoming a Corporation and issuing shares of stock. The owners would rather not do this because they wish to maintain control of the business. They would rather secure an additional bank loan but are concerned that a bank would view them as too much of a risk. They have the following financial information: Total Liabilities: $1,450,000 Total Assets: $1,780,000 Interest Expense: $98,720 Income before interest and taxes: $242,000 1. Calculate the Debt to Assets ratio and the Interest coverage ratio. (2) 2. Give your opinion about how the result of each ratio will be viewed by potential investors/shareholders and also by a bank. There is information in content to help you. (2) 3. Give your opinion (supported by two reasons) about whether they should become a Corporation or not. (2) PART B - Bonds 1. On January 1, 2014, Bernard Ltd. issues 500 5% bonds with a face value of $1.000. The bonds mature on December 31, 2023 and pay interest semi-annually. Prepare all the necessary journal entries to record the issue of the bonds for each of the following scenarios . bonds sold at 100 bonds sold at 102 bonds sold at 98.2 2. Record the bond interest expense on June 30, 2014 for each of the above scenarios,

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

You have provided images of a finance and accounting exercise that seems to be a part of an assignment or study material The images include questions related to the calculation of financial ratios opi... View full answer

Get step-by-step solutions from verified subject matter experts