Question: You commit $1,000,000 to the Citadel Hedge Fund at the beginning of the year. The fund increased in value by 25% during the year to

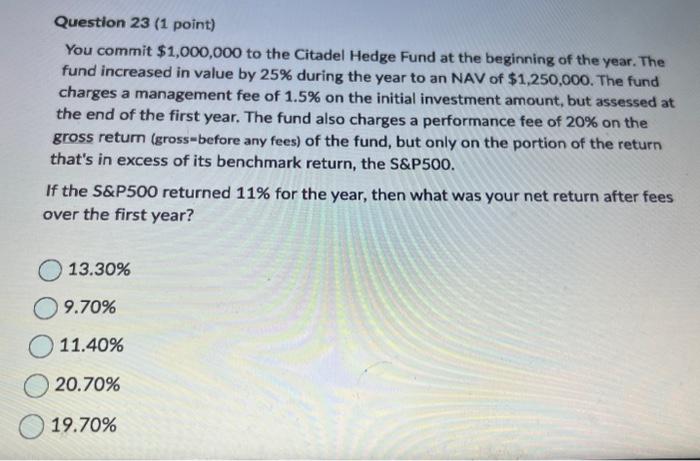

You commit $1,000,000 to the Citadel Hedge Fund at the beginning of the year. The fund increased in value by 25% during the year to an NAV of $1,250,000. The fund charges a management fee of 1.5% on the initial investment amount, but assessed at the end of the first year. The fund also charges a performance fee of 20% on the gross return (gross-before any fees) of the fund, but only on the portion of the return that's in excess of its benchmark return, the S\&P500. If the S\&PSOO returned 11% for the year, then what was your net return after fees over the first year? 13.30% 9.70% 11.40% 20.70% 19.70%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts