Question: You consider issuing a 4-year bond which, unlike normal bonds, does not pay any face value at maturity. The bond only pays coupons that

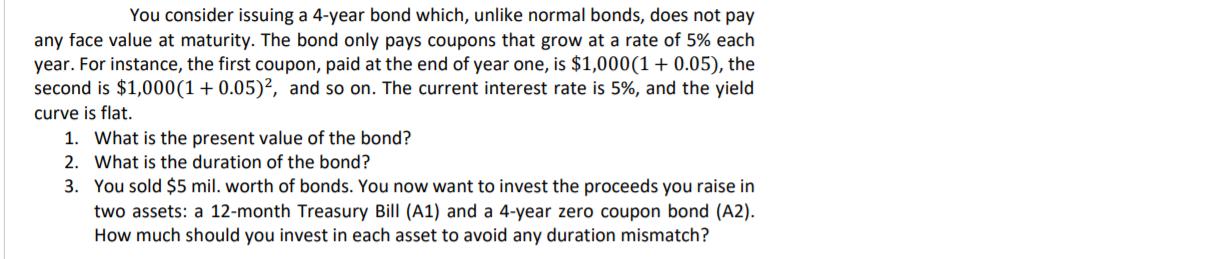

You consider issuing a 4-year bond which, unlike normal bonds, does not pay any face value at maturity. The bond only pays coupons that grow at a rate of 5% each year. For instance, the first coupon, paid at the end of year one, is $1,000 (1 + 0.05), the second is $1,000 (1+0.05), and so on. The current interest rate is 5%, and the yield curve is flat. 1. What is the present value of the bond? 2. What is the duration of the bond? 3. You sold $5 mil. worth of bonds. You now want to invest the proceeds you raise in two assets: a 12-month Treasury Bill (A1) and a 4-year zero coupon bond (A2). How much should you invest in each asset to avoid any duration mismatch?

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

To calculate the present value of the bond we need to find the present value of each coupon payment and sum them up The coupon payments are growing at ... View full answer

Get step-by-step solutions from verified subject matter experts