Question: You consider purchasing a new computing system, including networking, for your sales force for $112,000. The system has a 6-year useful life and no salvage

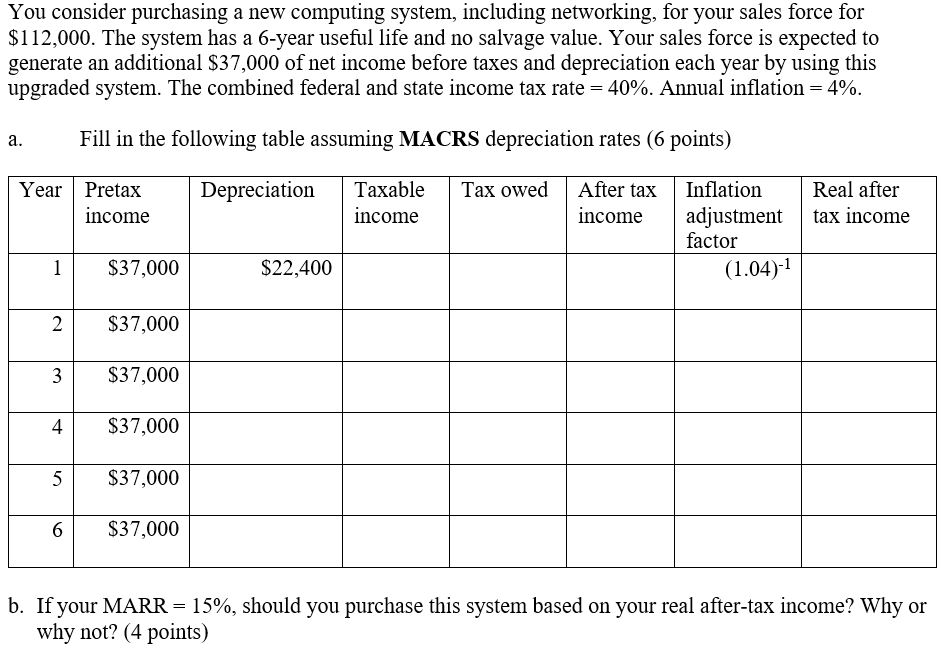

You consider purchasing a new computing system, including networking, for your sales force for $112,000. The system has a 6-year useful life and no salvage value. Your sales force is expected to generate an additional $37,000 of net income before taxes and depreciation each year by using this upgraded system. The combined federal and state income tax rate 40%. Annual inflation 4% Fill in the following table assuming MACRS depreciation rates (6 points) a. Year Pretax After tax Real after Depreciation Taxable Tax owed Inflation income income income adjustment factor tax income $37,000 $22,400 (1.04)1 $37,000 2 $37,000 3 $37,000 4 $37,000 5 $37,000 b. If your MARR why not? (4 points) 15%, should you purchase this system based on your real after-tax income? Why or

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts