Question: You consider two bonds ( A and B ) that are identical (same company, same maturity, same coupon, etc.). The only difference between the two

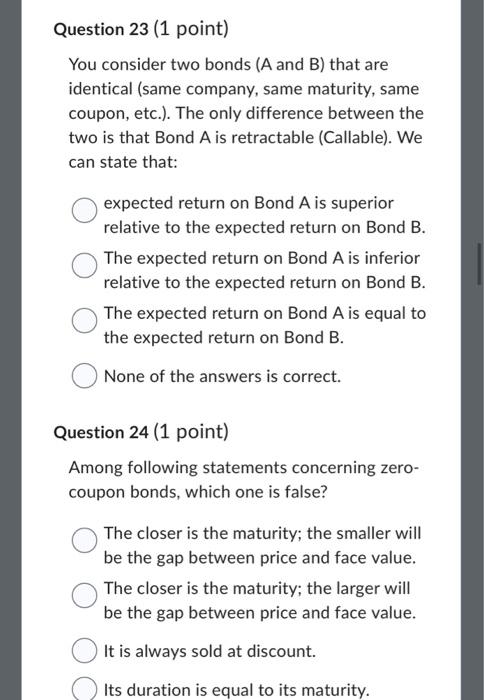

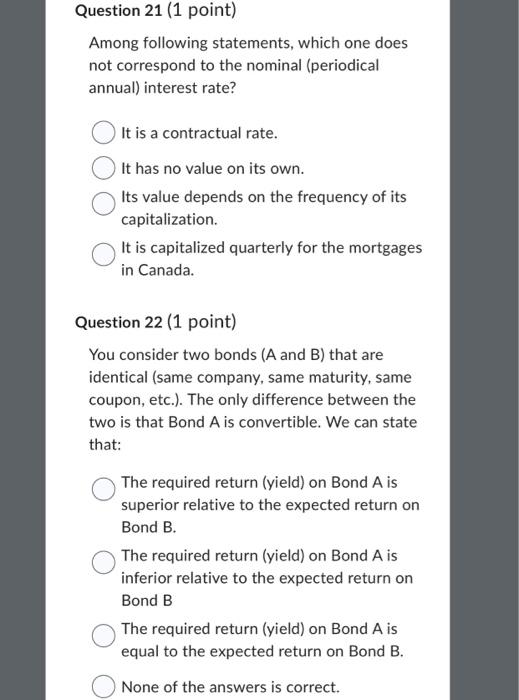

You consider two bonds ( A and B ) that are identical (same company, same maturity, same coupon, etc.). The only difference between the two is that Bond A is retractable (Callable). We can state that: expected return on Bond A is superior relative to the expected return on Bond B. The expected return on Bond A is inferior relative to the expected return on Bond B. The expected return on Bond A is equal to the expected return on Bond B. None of the answers is correct. Question 24 (1 point) Among following statements concerning zerocoupon bonds, which one is false? The closer is the maturity; the smaller will be the gap between price and face value. The closer is the maturity; the larger will be the gap between price and face value. It is always sold at discount. Its duration is equal to its maturity. Among following statements, which one does not correspond to the nominal (periodical annual) interest rate? It is a contractual rate. It has no value on its own. Its value depends on the frequency of its capitalization. It is capitalized quarterly for the mortgages in Canada. Question 22 (1 point) You consider two bonds ( A and B ) that are identical (same company, same maturity, same coupon, etc.). The only difference between the two is that Bond A is convertible. We can state that: The required return (yield) on Bond A is superior relative to the expected return on Bond B. The required return (yield) on Bond A is inferior relative to the expected return on Bond B The required return (yield) on Bond A is equal to the expected return on Bond B. None of the answers is correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts