Question: You decide to value a steady-state company using probability-weighted scenario analysis. In scenario 1, NOPLAT is expected to grow at 6 percent, and ROIC equals

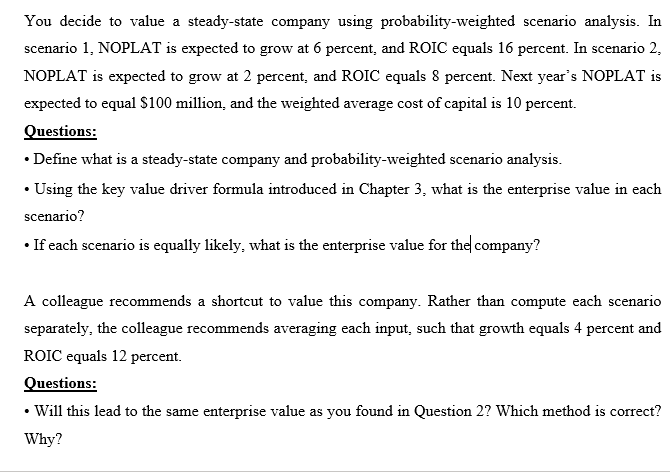

You decide to value a steady-state company using probability-weighted scenario analysis. In scenario 1, NOPLAT is expected to grow at 6 percent, and ROIC equals 16 percent. In scenario 2, NOPLAT is expected to grow at 2 percent, and ROIC equals 8 percent. Next year's NOPLAT is expected to equal $100 million and the weighted average cost of capital is 10 percent. Questions: Define what is a steady-state company and probability-weighted scenario analysis. Using the key value driver formula introduced in Chapter 3. what is the enterprise value in each scenario? If each scenario is equally likely, what is the enterprise value for the company? A colleague recommends a shortcut to value this company. Rather than compute each scenario separately, the colleague recommends averaging each input, such that growth equals 4 percent and ROIC equals 12 percent. Questions: Will this lead to the same enterprise value as you found in Question 2? Which method is correct? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts