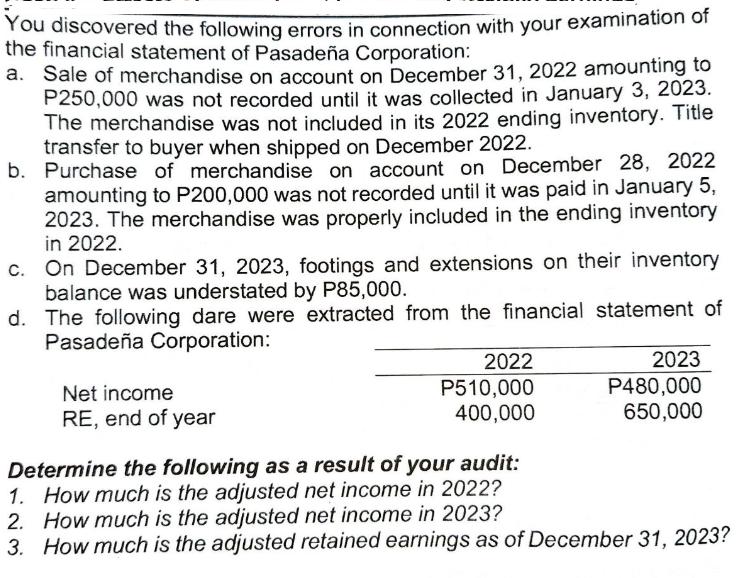

Question: You discovered the following errors in connection with your examination of the financial statement of Pasadea Corporation: a. Sale of merchandise on account on

You discovered the following errors in connection with your examination of the financial statement of Pasadea Corporation: a. Sale of merchandise on account on December 31, 2022 amounting to P250,000 was not recorded until it was collected in January 3, 2023. The merchandise was not included in its 2022 ending inventory. Title transfer to buyer when shipped on December 2022. b. Purchase of merchandise on account on December 28, 2022 amounting to P200,000 was not recorded until it was paid in January 5, 2023. The merchandise was properly included in the ending inventory in 2022. c. On December 31, 2023, footings and extensions on their inventory balance was understated by P85,000. d. The following dare were extracted from the financial statement of Pasadea Corporation: Net income RE, end of year 2022 P510,000 400,000 2023 P480,000 650,000 Determine the following as a result of your audit: 1. How much is the adjusted net income in 2022? 2. How much is the adjusted net income in 2023? 3. How much is the adjusted retained earnings as of December 31, 2023?

Step by Step Solution

3.39 Rating (161 Votes )

There are 3 Steps involved in it

To determine the adjusted net income and retained earnings for Pasadea Corporation we need to make t... View full answer

Get step-by-step solutions from verified subject matter experts