Question: you do not need to solve A. only B,C, and D Richard, age 35, is married and has two children, ages 2 and 5. He

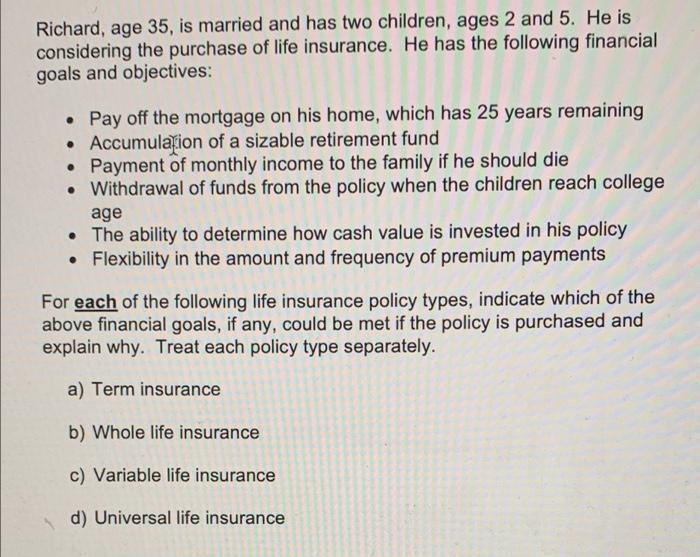

Richard, age 35, is married and has two children, ages 2 and 5. He is considering the purchase of life insurance. He has the following financial goals and objectives: Pay off the mortgage on his home, which has 25 years remaining Accumulation of a sizable retirement fund Payment of monthly income to the family if he should die Withdrawal of funds from the policy when the children reach college age The ability to determine how cash value is invested in his policy Flexibility in the amount and frequency of premium payments For each of the following life insurance policy types, indicate which of the above financial goals, if any, could be met if the policy is purchased and explain why. Treat each policy type separately. a) Term insurance b) Whole life insurance c) Variable life insurance d) Universal life insurance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts