Question: you dont need a PV factor table for this exercise thank you Sunland Company is considering buying a new farm that it plans to operate

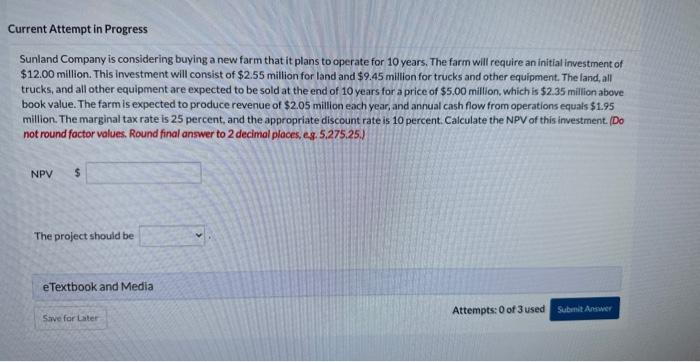

Sunland Company is considering buying a new farm that it plans to operate for 10 years. The farm will require an initial investment of $12.00 million. This investment will consist of $2.55 milion for land and $9.45million for trucks and other equipment. The land, all trucks, and all other equipment are expected to be sold at the end of 10 years for a price of $5.00 million, which is $2.35 million above book value. The farm is expected to produce revenue of $2.05 million each year, and annual cash flow from operations equals $1.95 million. The marginal tax rate is 25 percent, and the appropriate discount rate is 10 percent. Calculate the NPV of this investment. (Do not round foctor values. Round final answer to 2 decimal ploces, eg 5,275,25. NPV $ The project should be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts