Question: *** you don't need to show work manually*** please show what numbers you would enter into the calculator for example (N=, I=, PV=, PMT=, FV=,

*** you don't need to show work manually*** please show what numbers you would enter into the calculator for example (N=, I=, PV=, PMT=, FV=, P/Y=) please show where you get the numbers for PMT. thank you

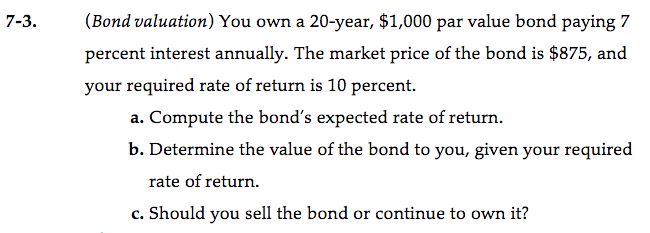

7-3. (Bond valuation) You own a 20-year, $1,000 par value bond paying 7 percent interest annually. The market price of the bond is $875, and your required rate of return is 10 percent. a. Compute the bond's expected rate of return. b. Determine the value of the bond to you, given your required rate of return. c. Should you sell the bond or continue to own it

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts