Question: You establish a straddle on Walmart using September call and put options with a strike price of $89. The call premium is $7.45 and the

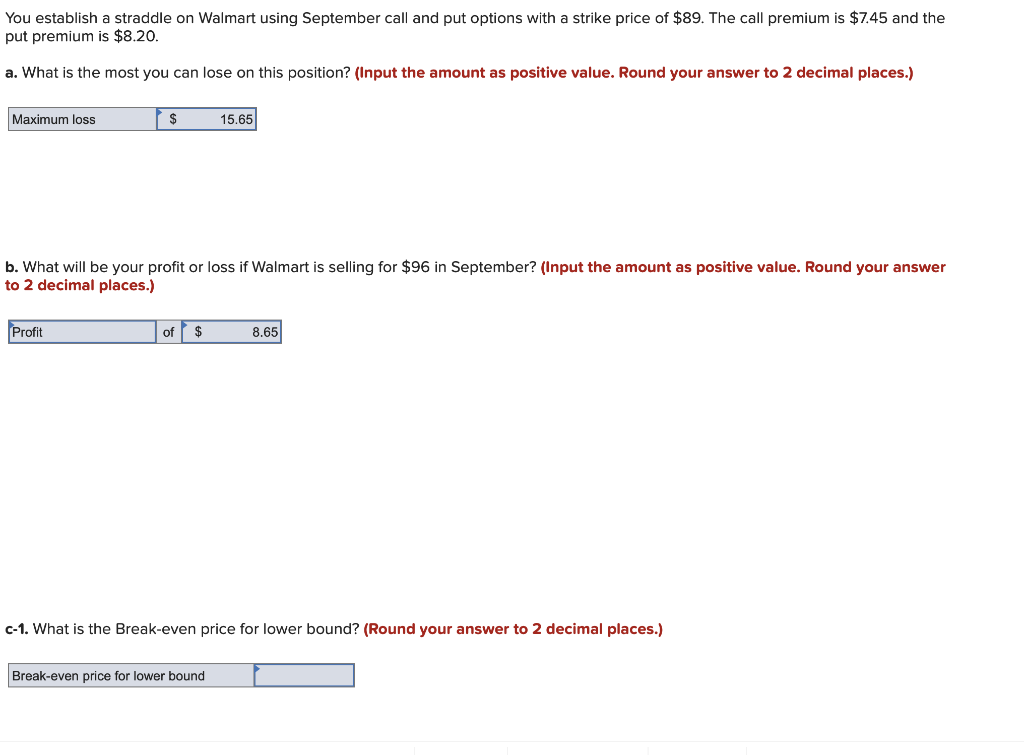

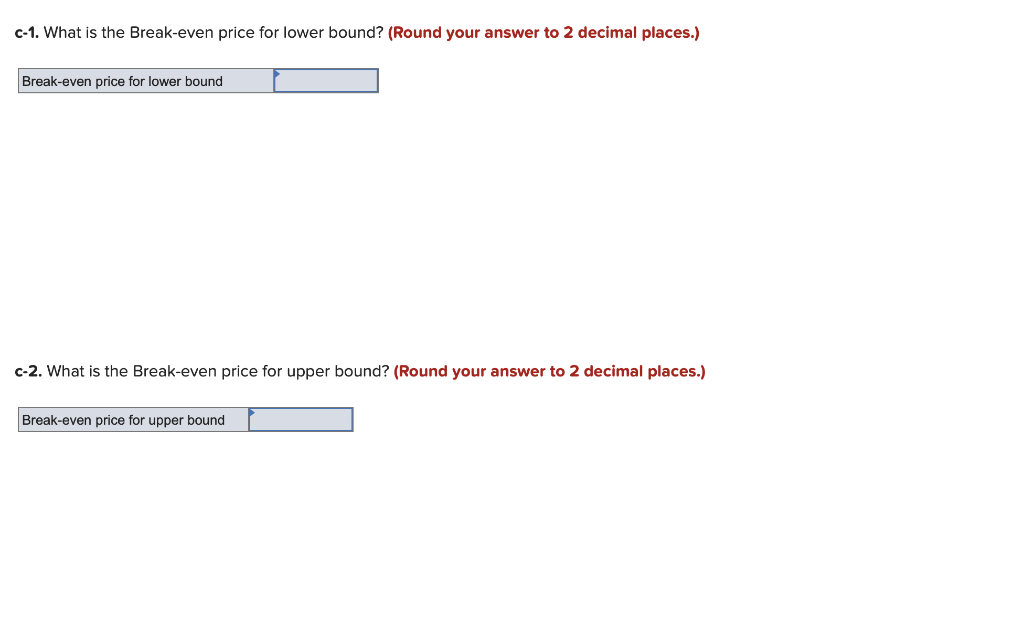

You establish a straddle on Walmart using September call and put options with a strike price of $89. The call premium is $7.45 and the put premium is $8.20. a. What is the most you can lose on this position? (Input the amount as positive value. Round your answer to 2 decimal places.) Maximum loss $ 15.65 b. What will be your profit or loss if Walmart is selling for $96 in September? (Input the amount as positive value. Round your answer to 2 decimal places.) Profit of $ 8.65 C-1. What is the Break-even price for lower bound? (Round your answer to 2 decimal places.) Break-even price for lower bound C-1. What is the Break-even price for lower bound? (Round your answer to 2 decimal places.) Break-even price for lower bound c-2. What is the Break-even price for upper bound? (Round your answer to 2 decimal places.) Break-even price for upper bound

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts