Question: You estimate the Single-Index Model (SIM) for Cisco using monthly stock returns over the time-period from 1/1993-12/2022. Today is 1/2023. According to the estimates, the

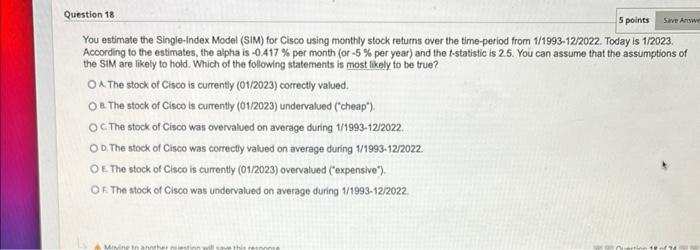

You estimate the Single-Index Model (SIM) for Cisco using monthly stock returns over the time-period from 1/1993-12/2022. Today is 1/2023. According to the estimates, the alpha is 0.417% per month (or 5% per year) and the t-statistic is 2.5 . You can assume that the assumptions of the SiM are likely to hold. Which of the following statements is most likely to be true? A. The stock of Cisco is currently (01/2023) correctly valued. B. The stock of Cisco is currently (01/2023) undervalued ("cheap') C.The stock of Cisco was overvalued on average during 1/1993-12/2022. D. The stock of Cisco was correctly valued on average during 1/1993-12/2022. E. The stock of Cisco is currently (01/2023) overvalued ("expensive'). E. The stock of Cisco was undervalued on average during 1/1993-12/2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts