Question: you found the portfolio that would be selected by an individual with the definition of the utility function that we used. Therefore, you have

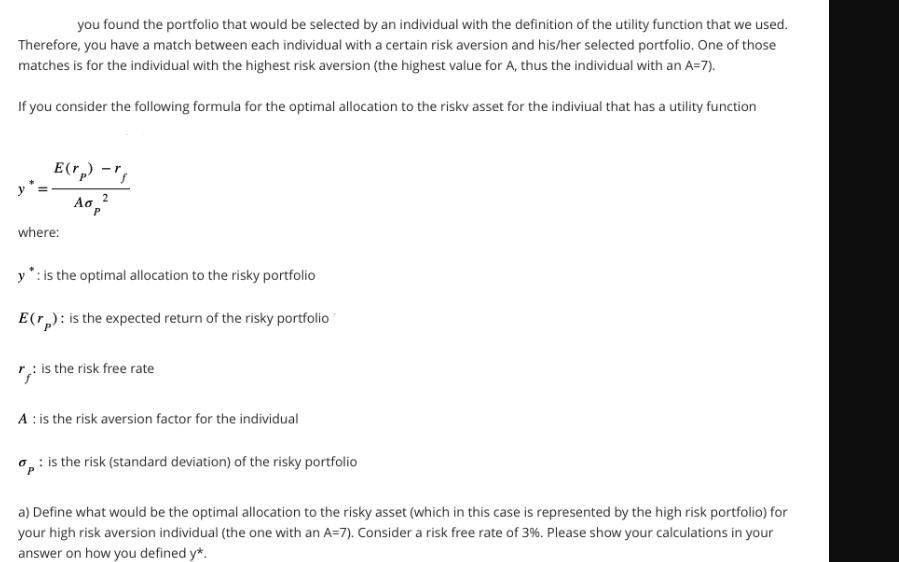

you found the portfolio that would be selected by an individual with the definition of the utility function that we used. Therefore, you have a match between each individual with a certain risk aversion and his/her selected portfolio. One of those matches is for the individual with the highest risk aversion (the highest value for A, thus the individual with an A=7). If you consider the following formula for the optimal allocation to the risky asset for the indiviual that has a utility function E(rp) -rf 2 where: Ao y": is the optimal allocation to the risky portfolio E(r): is the expected return of the risky portfolio r: is the risk free rate A: is the risk aversion factor for the individual op: is the risk (standard deviation) of the risky portfolio a) Define what would be the optimal allocation to the risky asset (which in this case is represented by the high risk portfolio) for your high risk aversion individual (the one with an A=7). Consider a risk free rate of 3%. Please show your calculations in your answer on how you defined y*.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts