Question: You got this question right in the previous attempt. View previous attempt Required information [The following information applies to the questions displayed below.) Hans runs

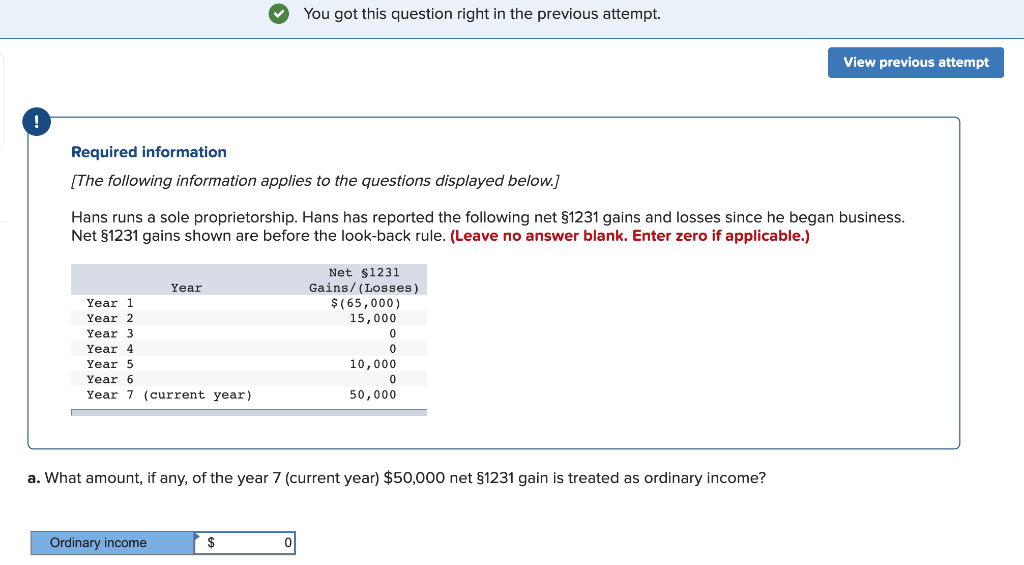

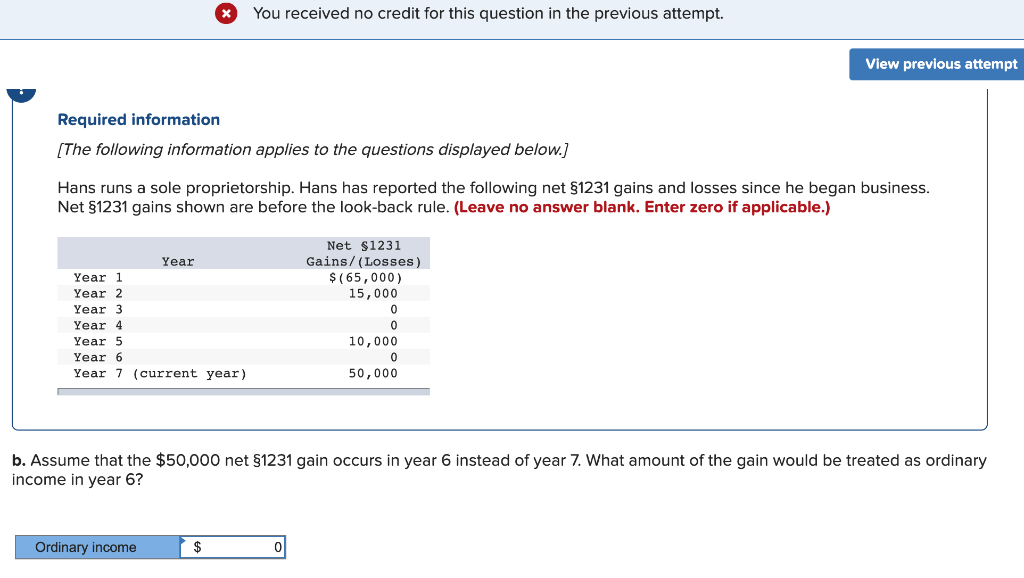

You got this question right in the previous attempt. View previous attempt Required information [The following information applies to the questions displayed below.) Hans runs a sole proprietorship. Hans has reported the following net $1231 gains and losses since he began business. Net $1231 gains shown are before the look back rule. (Leave no answer blank. Enter zero if applicable.) Year Net $1231 Gains/(Losses) $(65,000) 15,000 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 10,000 (current year) 50,000 a. What amount, if any, of the year 7 (current year) $50,000 net $1231 gain is treated as ordinary income? Ordinary income $ 0 You received no credit for this question in the previous attempt. View previous attempt Required information [The following information applies to the questions displayed below.) Hans runs a sole proprietorship. Hans has reported the following net $1231 gains and losses since he began business. Net $1231 gains shown are before the look-back rule. (Leave no answer blank. Enter zero if applicable.) Net $1231 Gains/(Losses) $(65,000) 15,000 Year Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 (current year) 10,000 50,000 b. Assume that the $50,000 net $1231 gain occurs in income in year 6? 6 instead of year 7. What amount of the gain would be treated as ordinary Ordinary income $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts