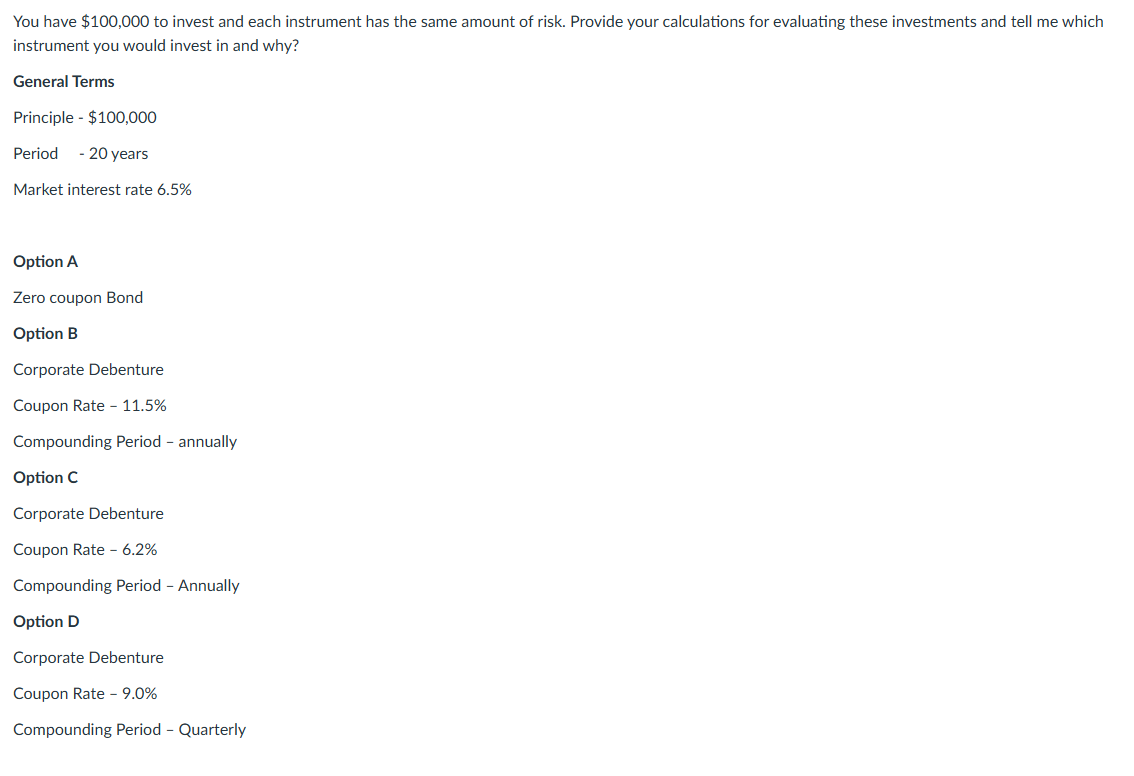

Question: You have $ 1 0 0 , 0 0 0 to invest and each instrument has the same amount of risk, which instrument would you

You have $ to invest and each instrument has the same amount of risk, which instrument would you invest in and why? General Terms Principle $ Period years Market interest rate Option A Zero coupon Bond Option B Corporate Debenture Coupon Rate Compounding Period annually Option C Corporate Debenture Coupon Rate Compounding Period Annually Option D Corporate Debenture Coupon Rate Compounding Period Quarterly You have $ to invest and each instrument has the same amount of risk. Provide your calculations for evaluating these investments and tell me which instrument you would invest in and why?

General Terms

Principle $

Period years

Market interest rate

Option A

Zero coupon Bond

Option B

Corporate Debenture

Coupon Rate

Compounding Period annually

Option C

Corporate Debenture

Coupon Rate

Compounding Period Annually

Option D

Corporate Debenture

Coupon Rate

Compounding Period Quarterly

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock