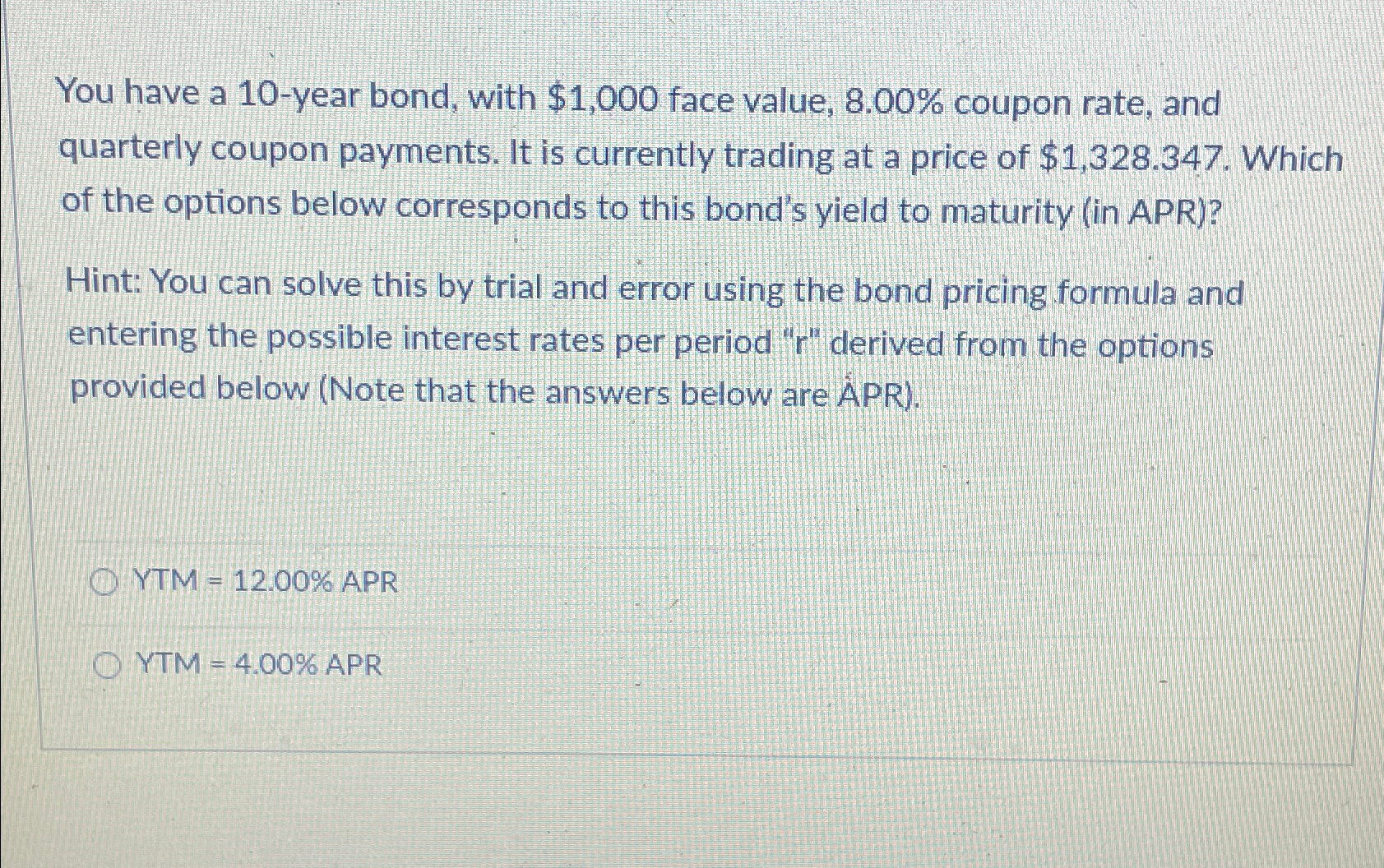

Question: You have a 1 0 - year bond, with $ 1 , 0 0 0 face value, 8 . 0 0 % coupon rate, and

You have a year bond, with $ face value, coupon rate, and quarterly coupon payments. It is currently trading at a price of $ Which of the options below corresponds to this bond's yield to maturity in APR

Hint: You can solve this by trial and error using the bond pricing formula and entering the possible interest rates per period derived from the options provided below Note that the answers below are APR

APR

APR

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock