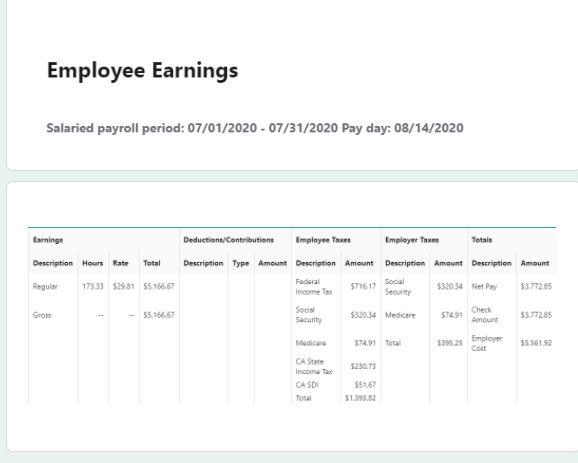

Question: You have a cash basis client. The client uses a 3rd party provider to process their own payroll and sends you the report above to

You have a cash basis client. The client uses a 3rd party provider to process their own payroll and sends you the report above to post in QBO. What is the journal entry that you would post in QBO and what is the date you would use?

Employee Earnings Salaried payroll period: 07/01/2020 - 07/31/2020 Pay day: 08/14/2020 Earning Deduction Contributions Employee Employer Tones Totals Description Hours Rate Total Regular 17333 $29.81 35166.67 Gross - 55166.67 Description Type Amount Description Amount Description Amount Description Amount Federal Socal 577617 Income $32034 Net Pry $3.77285 Security Social Check $320.34 Medicare $7491 Security Amount 53.72285 Medica 574,91 Total $395.35 Employer 55561.52 Cout CAS 5230.73 Income Tax CASDI 55167 Total L2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts