Question: You have already learned that when preparing financial statements, management makes assertions about each account and the relate disclosures in the notes. Auditors then

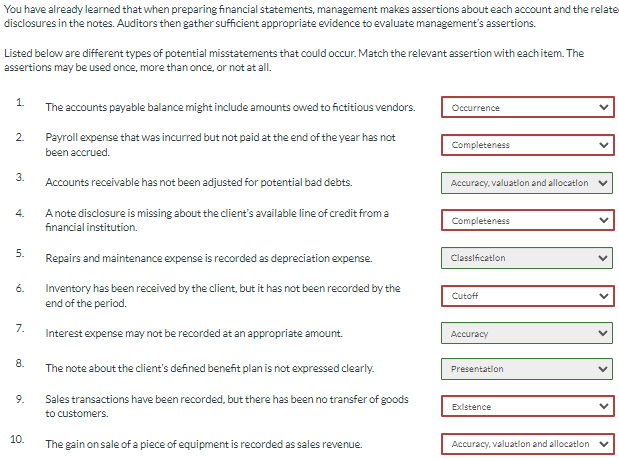

You have already learned that when preparing financial statements, management makes assertions about each account and the relate disclosures in the notes. Auditors then gather sufficient appropriate evidence to evaluate management's assertions. Listed below are different types of potential misstatements that could occur. Match the relevant assertion with each item. The assertions may be used once, more than once, or not at all. 1. The accounts payable balance might include amounts owed to fictitious vendors. Occurrence 2. Payroll expense that was incurred but not paid at the end of the year has not been accrued. Completeness 3. Accounts receivable has not been adjusted for potential bad debts. 4. 5. A note disclosure is missing about the client's available line of credit from a financial institution. Repairs and maintenance expense is recorded as depreciation expense. Accuracy, valuation and allocation Completeness Classification 6. Inventory has been received by the client, but it has not been recorded by the end of the period. 7. Interest expense may not be recorded at an appropriate amount. 8. 9. 10. Cutoff Accuracy The note about the client's defined benefit plan is not expressed clearly. Sales transactions have been recorded, but there has been no transfer of goods to customers. The gain on sale of a piece of equipment is recorded as sales revenue. Presentation Existence Accuracy, valuation and allocation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts