Question: You have an option for two different machines on your new project. Each machine will provide the same function, but there are differences in

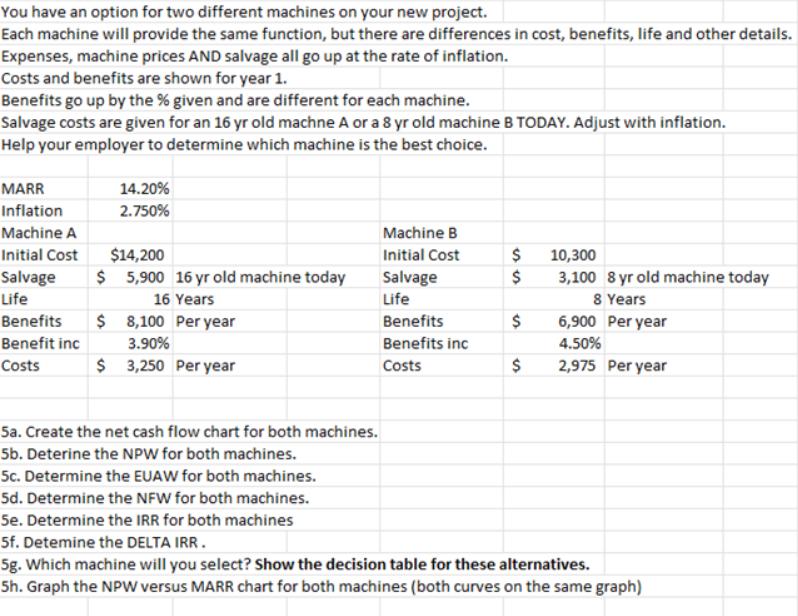

You have an option for two different machines on your new project. Each machine will provide the same function, but there are differences in cost, benefits, life and other details. Expenses, machine prices AND salvage all go up at the rate of inflation. Costs and benefits are shown for year 1. Benefits go up by the % given and are different for each machine. Salvage costs are given for an 16 yr old machne A or a 8 yr old machine B TODAY. Adjust with inflation. Help your employer to determine which machine is the best choice. MARR Inflation Machine A Initial Cost Salvage Life Benefits Benefit inc Costs 14.20% 2.750% $14,200 $ 5,900 16 yr old machine today 16 Years $ 8,100 Per year 3.90% $3,250 Per year 5a. Create the net cash flow chart for both machines. 5b. Deterine the NPW for both machines. 5c. Determine the EUAW for both machines. 5d. Determine the NFW for both machines. 5e. Determine the IRR for both machines Machine B Initial Cost Salvage Life Benefits Benefits inc Costs $ SS $ $ $ 10,300 3,100 8 yr old machine today 8 Years 6,900 per year 4.50% 2,975 Per year 5f. Determine the DELTA IRR. 5g. Which machine will you select? Show the decision table for these alternatives. 5h. Graph the NPW versus MARR chart for both machines (both curves on the same graph)

Step by Step Solution

3.50 Rating (153 Votes )

There are 3 Steps involved in it

To analyze the choice between Machine A and Machine B we will calculate various financial metrics and compare them Lets go through each step MARR 1420 ... View full answer

Get step-by-step solutions from verified subject matter experts