Question: You have been asked to estimate the levered beta for GenCorp, a Mexican company with food and tobacco subsidiaries. GenCorp has a debt-to-equity ratio of

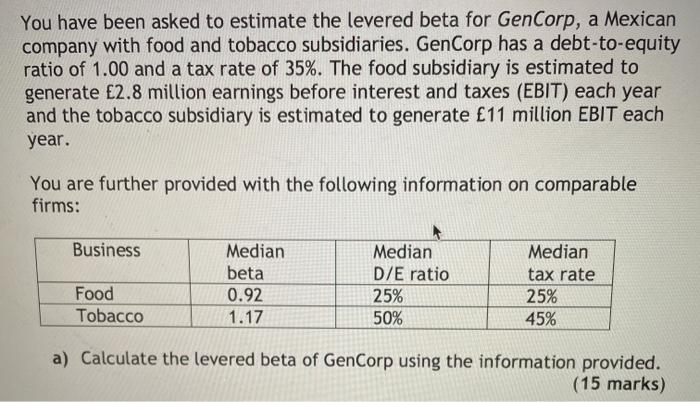

You have been asked to estimate the levered beta for GenCorp, a Mexican company with food and tobacco subsidiaries. GenCorp has a debt-to-equity ratio of 1.00 and a tax rate of 35%. The food subsidiary is estimated to generate 2.8 million earnings before interest and taxes (EBIT) each year and the tobacco subsidiary is estimated to generate 11 million EBIT each year. You are further provided with the following information on comparable firms: Business Median beta 0.92 1.17 Food Tobacco Median D/E ratio 25% 50% Median tax rate 25% 45% a) Calculate the levered beta of GenCorp using the information provided. (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts