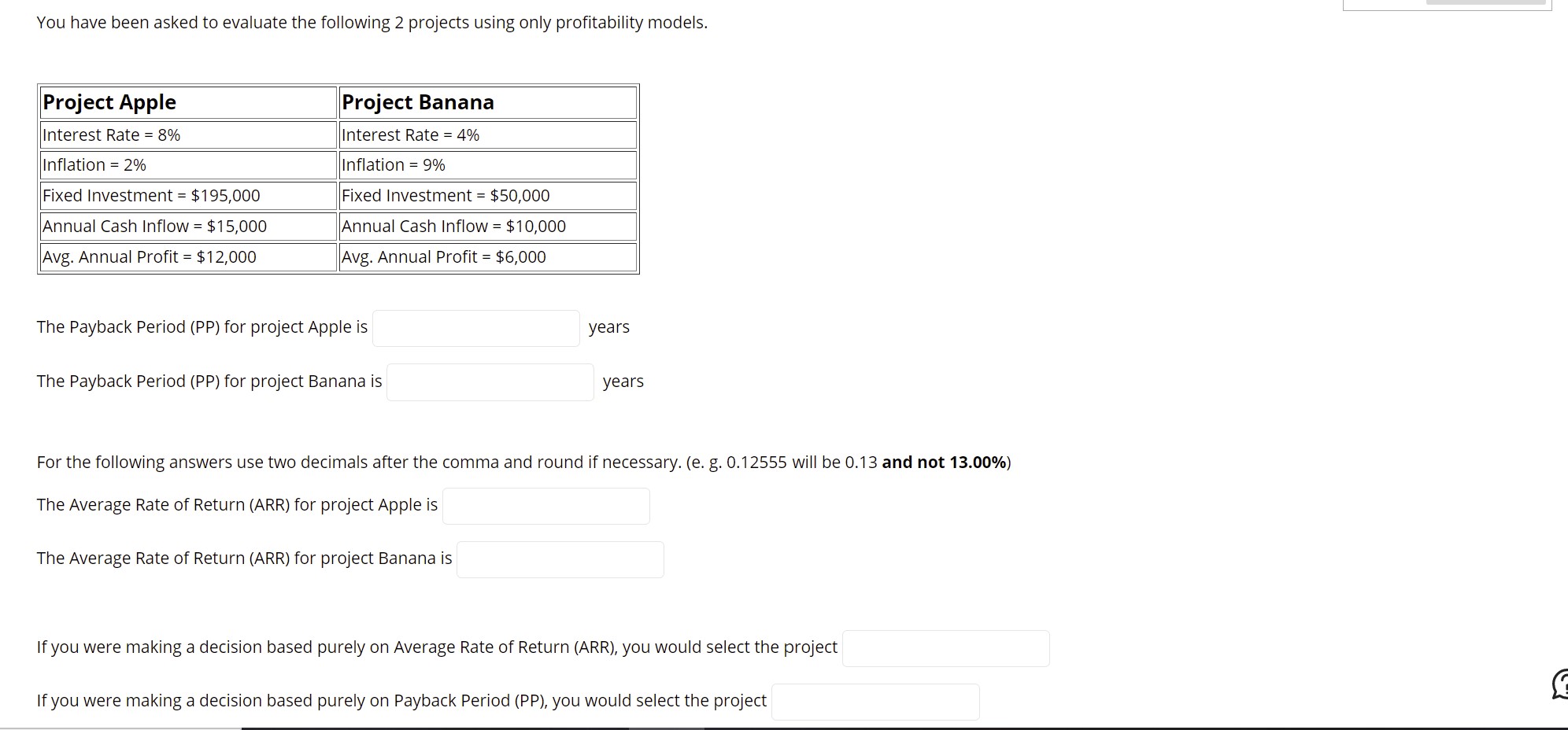

Question: You have been asked to evaluate the following 2 projects using only profitability models. Project Apple Interest Rate = 8% Inflation 2% Fixed Investment

You have been asked to evaluate the following 2 projects using only profitability models. Project Apple Interest Rate = 8% Inflation 2% Fixed Investment = $195,000 Annual Cash Inflow = $15,000 Avg. Annual Profit = $12,000 Project Banana Interest Rate = 4% Inflation 9% Fixed Investment = $50,000 Annual Cash Inflow $10,000 Avg. Annual Profit = $6,000 The Payback Period (PP) for project Apple is The Payback Period (PP) for project Banana is years years For the following answers use two decimals after the comma and round if necessary. (e. g. 0.12555 will be 0.13 and not 13.00%) The Average Rate of Return (ARR) for project Apple is The Average Rate of Return (ARR) for project Banana is If you were making a decision based purely on Average Rate of Return (ARR), you would select the project If you were making a decision based purely on Payback Period (PP), you would select the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts