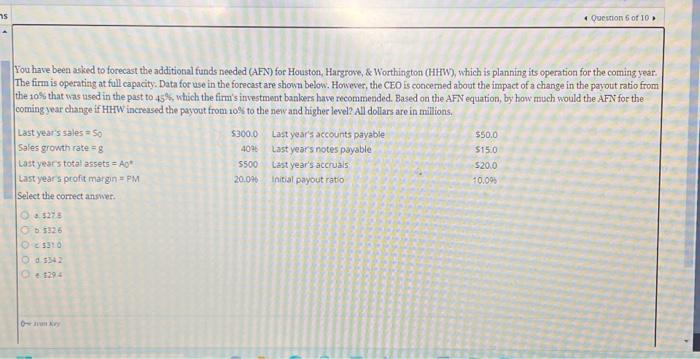

Question: You have been asked to forecast the additional funds needed (AFN) for Houston, Harsrone, & Worthington (HHW), which is planning its operntion for the coming

You have been asked to forecast the additional funds needed (AFN) for Houston, Harsrone, \& Worthington (HHW), which is planning its operntion for the coming year. The firm is openting at full capacity. Data for use in the forecast are shown below. Hoveve, the CEO is concemed about the impact of a change in the payout ratio from the 10% that was used in the past to 45%, which the firm's investment bankers have recommended. Based on the AFN equation, by how much would the AFN for the coming year change if HHW increased the payout from 10 \% to the nev and higher level? All dollars are in millions

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock