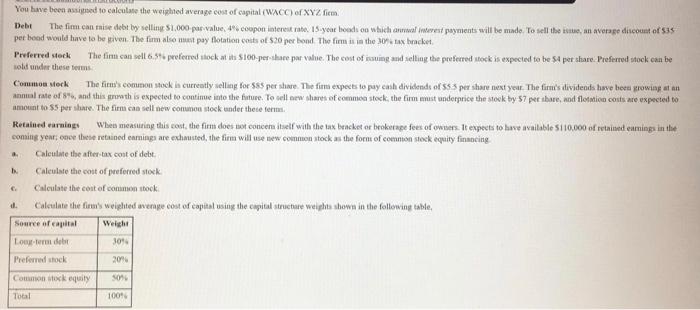

Question: You have been assigned to calculate the weighted average cost of capital (WACC) XYZ firm Debt The fim.can raise debt by selling 1.000 par value,

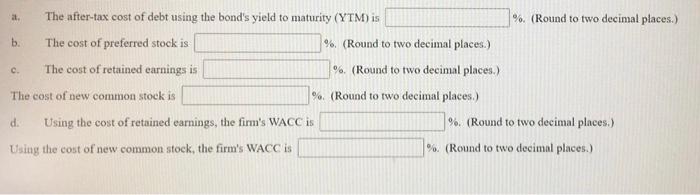

You have been assigned to calculate the weighted average cost of capital (WACC) XYZ firm Debt The fim.can raise debt by selling 1.000 par value, 4 coupon interest rate, 15 year boods on which www.ext payments will be made. To sell them, an average discount of 534 pet bood would have to be given. The fimm also must pay flotation colts of 20 per bond. The firm it in the tax bracket Preferred stock The timcan vell 6.5t perferred stock at the $100-perche par vahie. The cost of issuing and setting the perfecred stock is expected to be 54 pet share. Preferred stock can be old under these terms Common Mock The firm's common shock is currently selling for $85 per share. The fim expects to pay cash dividends of 555 per share next year. The firm's dividends have been growing aan animal rate of 8%, and this groth is expected to continue into the future. To cell new shares of common steck, the Gimmest underprice the stock by 57 per share, and flotion costs are expected to amount to SS per share. The firm can tell new common stock under these term. Retained earnings When measuring this cout, the firm does not concenu itell with the tax borcket or brokerage fees of owners. It expect to have wailable 5110,000 of retained earnings in the coming year, enve the retained earnings are exhausted, the fimm will use new common stock as the form of common teck equity financing Calculate the after tax cost of det Calculate the cost of preferred stock Calculate the cost of common stock Coleslate the firm's weighted average cost of capital using the capital structure weights shown in the following table, Source of capital Weight Lorem debe 30% Preferred shock 20% c. ul SOM Common lock equity Total 10046 c. a. The after-tax cost of debt using the bond's yield to maturity (YTM) is %. (Round to two decimal places.) b. The cost of preferred stock is %. (Round to two decimal places.) The cost of retained earnings is %. (Round to two decimal places.) The cost of new common stock is %. (Round to two decimal places. d. Using the cost of retained earnings, the firm's WACC is %. (Round to two decimal places.) Using the cost of new common stock, the firm's WACC IS %. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts