Question: You have been given an assignment to audit a salary expense for an employee who is currently employed. Kerry Jennings is the employee and

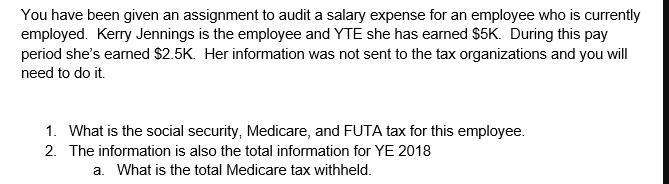

You have been given an assignment to audit a salary expense for an employee who is currently employed. Kerry Jennings is the employee and YTE she has earned $5K. During this pay period she's earned $2.5K. Her information was not sent to the tax organizations and you will need to do it. 1. What is the social security, Medicare, and FUTA tax for this employee. 2. The information is also the total information for YE 2018 a. What is the total Medicare tax withheld.

Step by Step Solution

There are 3 Steps involved in it

1 Social security Medicare and FUTA taxes for this pay period Social Secu... View full answer

Get step-by-step solutions from verified subject matter experts