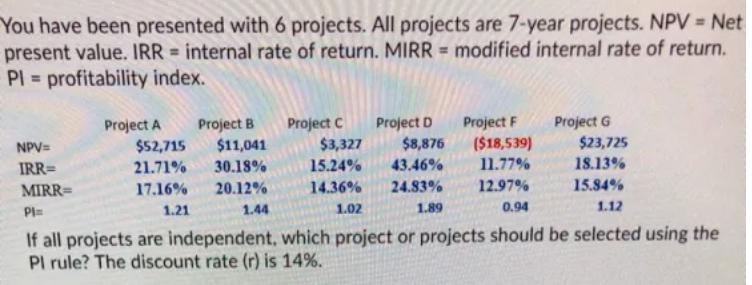

Question: You have been presented with 6 projects. All projects are 7-year projects. NPV = Net present value. IRR= internal rate of return. MIRR= modified

You have been presented with 6 projects. All projects are 7-year projects. NPV = Net present value. IRR= internal rate of return. MIRR= modified internal rate of return. PI= profitability index. NPV= IRR= MIRR= Pl= Project A Project B $52,715 $11,041 21.71% 30.18% 17.16% 20.12% 1.21 1.44 Project C Project D $3,327 $8,876 15.24% 43.46% 14.36% 24.83% 1.02 1.89 Project F Project G ($18,539) $23,725 11.77% 18.13% 12.97% 15.84% 0.94 1.12 If all projects are independent, which project or projects should be selected using the Pl rule? The discount rate (r) is 14%.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts