Question: You have been tasked with building a stand-alone DCF valuation for Graham Holdings (GHC), a publicly traded company, using the unlevered (two-stage) approach. You have

You have been tasked with building a stand-alone DCF valuation for Graham Holdings (GHC), a publicly traded company, using the unlevered (two-stage) approach.

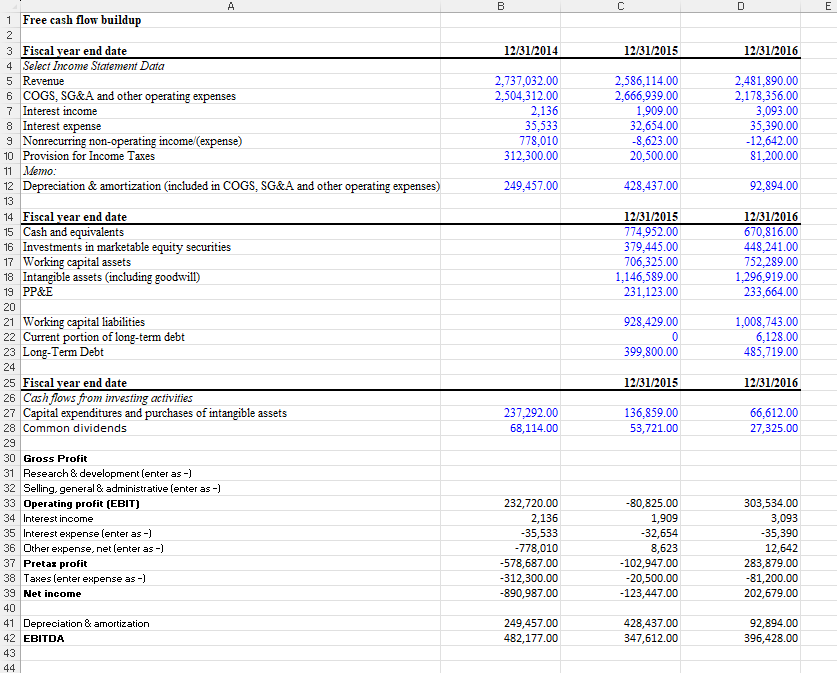

You have collected the data found in this file: GHC Free Cashflow DataLinks to an external site. (download the file by clicking the link and open it to answer this question).

Question: Using the data from the "GHC Free Cashflow Data" workbook, calculate 2016 unlevered free cash flows. Assume the tax rate = 2016 tax expense / pretax income.

Group of answer choices

241,530.0

268,855.0

270,976.7

282,966.0

333,379.0

Please give Excel calculations in answer as well.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts