Question: You have been tasked with fielding an interactive video communications systems. Your job is to provide the U.S. Army with the least expensive system (for

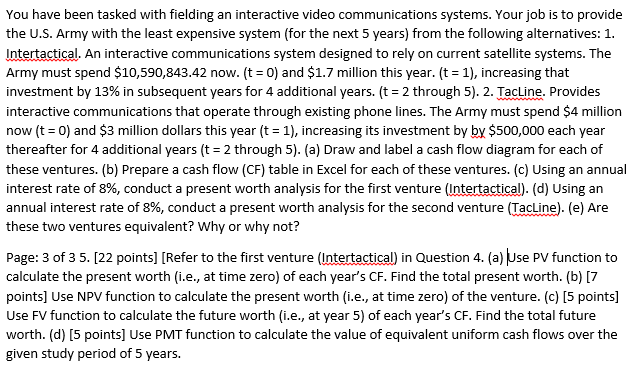

You have been tasked with fielding an interactive video communications systems. Your job is to provide the U.S. Army with the least expensive system (for the next 5 years) from the following alternatives: 1 Intertactical An interactive communications system designed to rely Army must spend $10,590,843.42 investment by 13% in subsequent years for 4 additional years. (t= 2 through 5). 2. TacLine. Provides on current satellite systems. The 1), increasing that now. (t 0) and $1.7 million this year. (t interactive communications that operate through existing phone lines. The Army must spend $4 million now (t 0) and $3 million dollars this year (t 1), increasing its investment by by $$500,000 each year thereafter for 4 additional years (t 2 through 5). (a) Draw and label a cash flow diagram for each of these ventures. (b) Prepare a cash flow (CF) table in Excel for each of these ventures. (c) Using an annual interest rate of 8%, conduct a present worth analysis for the first venture (Intertactical). (d) Using an annual interest rate of 8%, conduct a present worth analysis for the second venture (TacLine). (e) Are these two ventures equivalent? Why why not? Or Page: 3 of 3 5. [22 points] [Refer to the first venture (Intertactical) in Question 4. (a) Use PV function to calculate the present worth (i.e., at time zero) of each year's CF. Find the total present worth. (b) [7 points] Use NPV function to calculate the present worth (i.e., at time zero) of the venture. (c) [5 points] Use FV function to calculate the future worth (i.e., at year 5) of each year's CF. Find the total future worth. (d) [5 points] Use PMT function to calculate the value of equivalent uniform cash flows over the given study period of 5 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts