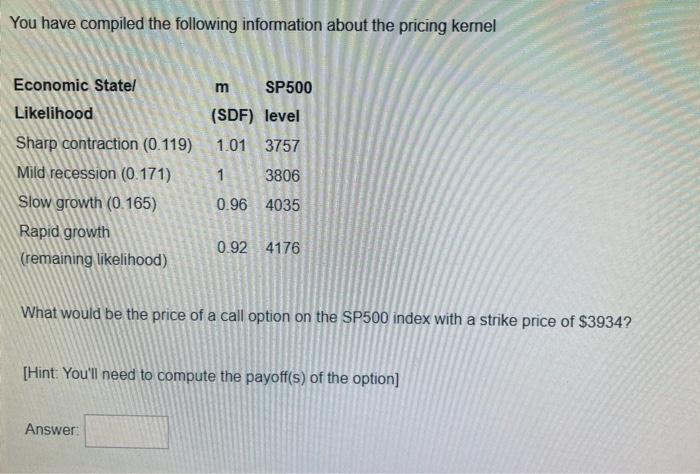

Question: You have compiled the following information about the pricing kernel Economic State/ Likelihood m (SDF) SP500 level Sharp contraction (0.119) 1.01 3757 Mild recession (0.171)

You have compiled the following information about the pricing kemel What would be the price of a call option on the SP500 index with a strike price of $3934 ? [Hint: You'll need to compute the payoff(s) of the option]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts