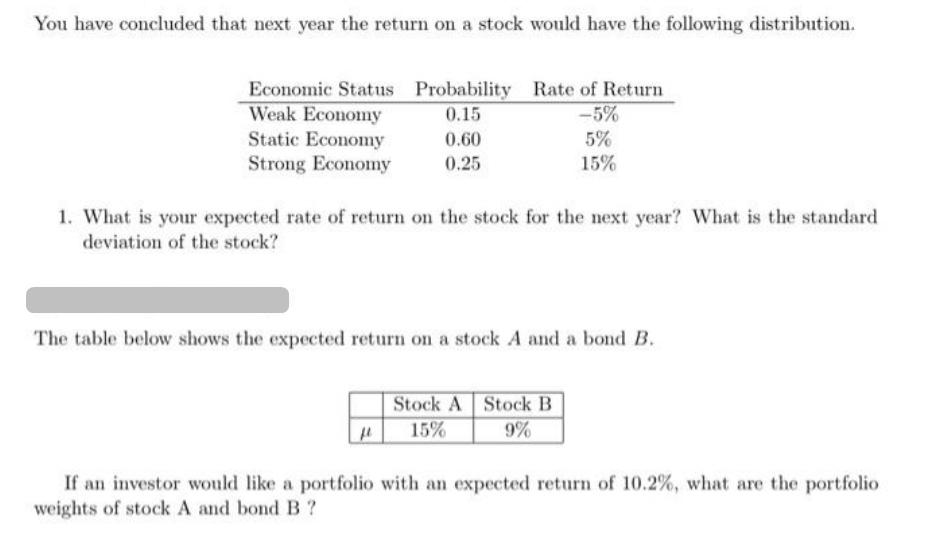

Question: You have concluded that next year the return on a stock would have the following distribution. Economic Status Probability Weak Economy 0.15 Static Economy

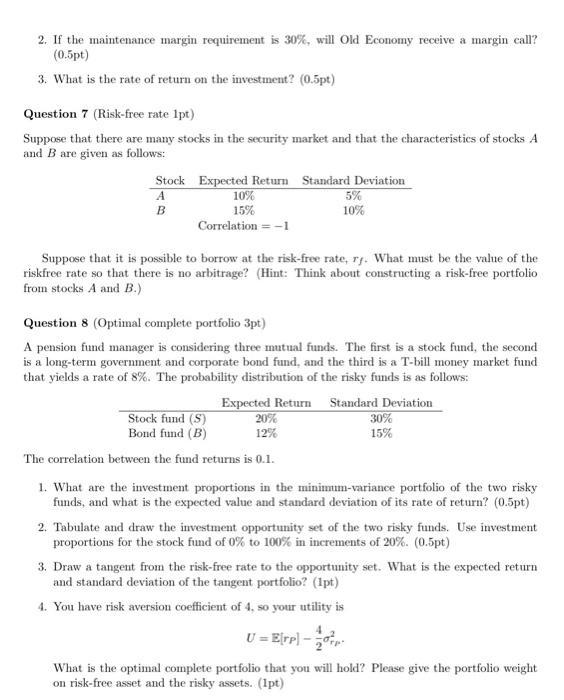

You have concluded that next year the return on a stock would have the following distribution. Economic Status Probability Weak Economy 0.15 Static Economy Strong Economy 0.60 0.25 Rate of Return -5% 5% 15% 1. What is your expected rate of return on the stock for the next year? What is the standard deviation of the stock? f The table below shows the expected return on a stock A and a bond B. Stock A Stock B 9% 15% If an investor would like a portfolio with an expected return of 10.2%, what are the portfolio weights of stock A and bond B? An investor has $10,000. She decides to have the following asset allocations: Stock A Treasury-Bill -20% 120% w How to interpret her portfolio weights? What is her investment in government bond and what is her investment in stock A? Recall from class that the population variance and standard deviation of portfolio has the following formulas. With two assets A and B: If the portfolio weight on asset A is and the the portfolio weight on asset B w, then =A+B Var(r) (u) Var(-) + () Var() + Cov(r) + ww Cov(r). With more than two assets: If the portfolio weight on asset i is a, and asset i has return r, then i=1 NN Var()-(w) Var(r) + u'w Cour.r) i=1 Suppose that an investor holds a portfolio of bonds X,Y and Z. Portfolio weights of the three assets are 20%, 50% and 30%, respectively. The table below shows the variance-covariance matrix of the three assets. What is the standard deviation of the portfolio? X Z X 0.0200 0.0150 0.0350 Y 0.0150 0.0500 0.0250 0.0350 0.0250 0.0100 Z Question 5 (AMR and GMR 0.5pt) The table below shows annual holding period returns on a stock over five years. What are the arithmetic and geometric means (AMR and GMR) of the stock's returns? Year HPR 1 10% 2 12% 8% 2% -3% 3 4 5 Question 6 (Margin trade 3pt) Old Economy Traders opened an account to short sell 1,000 shares of Internet Dreams from the previous problem. After borrowing the shares of Internet Dreams, Old Economy Traders immedi- ately sells the shares in the market at $60. After the sale of the shares, Old Economy Traders will not receive the dividend from the company. The initial margin requirement was 50%. (The margin account pays no interest.) A year later, the price of Internet Dreams has fallen from 860 to $50, and the stock paid a divide per share in between. 1. What is the remaining margin in the account? (2pt) 82 2. If the maintenance margin requirement is 30%, will Old Economy receive a margin call? (0.5pt) 3. What is the rate of return on the investment? (0.5pt) Question 7 (Risk-free rate 1pt) Suppose that there are many stocks in the security market and that the characteristics of stocks A and B are given as follows: Stock Expected Return Standard Deviation 5% A 10% B 15% 10% Correlation = -1 Suppose that it is possible to borrow at the risk-free rate, ry. What must be the value of the riskfree rate so that there is no arbitrage? (Hint: Think about constructing a risk-free portfolio from stocks A and B.) Question 8 (Optimal complete portfolio 3pt) A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-bill money market fund that yields a rate of 8%. The probability distribution of the risky funds is as follows: Expected Return Standard Deviation 20% 12% Stock fund (S) Bond fund (B) The correlation between the fund returns is 0.1. 30% 15% 1. What are the investment proportions in the minimum-variance portfolio of the two risky funds, and what is the expected value and standard deviation of its rate of return? (0.5pt) 2. Tabulate and draw the investment opportunity set of the two risky funds. Use investment proportions for the stock fund of 0% to 100% in increments of 20%. (0.5pt) 3. Draw a tangent from the risk-free rate to the opportunity set. What is the expected return and standard deviation of the tangent portfolio? (1pt) 4. You have risk aversion coefficient of 4, so your utility is U = Erp) - What is the optimal complete portfolio that you will hold? Please give the portfolio weight on risk-free asset and the risky assets. (1pt)

Step by Step Solution

There are 3 Steps involved in it

To calculate the expected rate of return on the stock for the next year we can multiply the probabil... View full answer

Get step-by-step solutions from verified subject matter experts